GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

“When I was a boy of 14, my father was so ignorant, I could hardly stand to have the old man around. But when I got to 21, I was astonished at how much the old man had learned in seven years.” – Mark Twain

“Baseball is too much a sport to be a business and too much a business to be a sport.” – Phil Wrigley, former owner of the Chicago Cubs

“Why not? I had a better year than he did.” – Babe Ruth when asked if he thought it was fair he made more than President Hoover in 1930

Since it’s Father’s Day, I get to especially reflect on my Dad and the lessons he taught me.

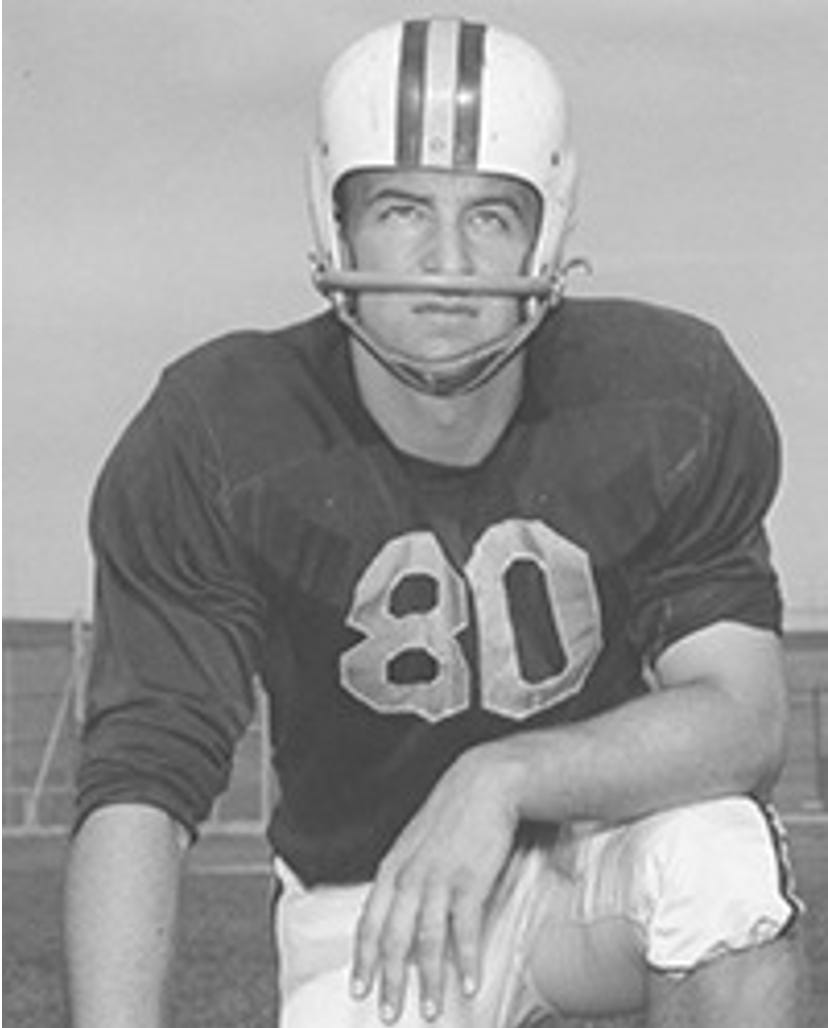

My Dad is a sports nut. And he was an amazing athlete. He was a two-sport star at the University of Minnesota where he was the MVP of the football team as a receiver and batted .330 as a first baseman for the Gophers College World Series Championship team.

If he had it his way, he’d wake up and play a round of golf, followed by a tennis match, and then watch any sport on TV. To him, sports revealed more about a person's character than their SAT score or college pedigree ever could. The type of teammate someone was and how they competed told him all he needed to know. In fact, Dad told me he only liked to hire people who had played TEAM sports to work with him.

My Dad believed there was a 100% correlation between success in athletics and success in life. When he’d share his philosophy with me, I’d think he was on Mars. I thought, “Come on, sports is fun and games, and life is serious.”

Much like the Mark Twain quote, I realized how much wisdom my Dad had provided me as I got older, had a family, and started several businesses.

While sports were clearly my Dad’s passion (and some could argue religion), he didn’t pursue a career as a professional athlete.

Why?

Because in 1960, the year he graduated from college, professional athletics wasn’t a real career for all but a very few, and Dad already had started a family – my older sister Laura was born in March of that year. So, he went to law school.

In the 1950’s, the average salary in the NFL was $6K and most players had to work a side job to pay the bills. On the 1964 Cleveland Browns championship team, star running back Jim Brown worked for Pepsi during the offseason, Chuck Noll was a freight salesman and Willie Davis was a school teacher.

In 1966, future three-time Cy Young winner and Hall of Famer Jim Palmer threw a shutout in game 2 of the World Series against the LA Dodgers. One week later he was selling clothes at a haberdashery in downtown Baltimore. “Cakes’” $7,500 salary wasn’t going to provide him with “champagne wishes and caviar dreams.”

QB1 of America’s TEAM, Roger Staubach, won two Super Bowls in his eleven seasons with the Cowboys and his salary in his final year 1979 was $160K. Staubach started selling commercial real estate after his rookie season to supplement his income. This venture would become the Staubach Company, and the business was acquired by JLL in 2008 for $613 million dollars.

You could say “all’s well that ends well” but if Roger the Dodger was in the NFL today, he wouldn’t have had to have a side hustle to get his. Consider this: just last week Jacksonville Jaguars QB Trevor Lawrence signed a five-year $275 million dollar contract. With him as a starter, the Jaguars have 20 wins and 30 losses. Staubach had 20 playoff wins.

And Lawrence is not an outlier…the NFL’s going rate for a prime-time QB is $50 million+ per year. Two wit, Bengal QB Joe Burrow has a 5-year, $275 million deal, and Justin Herbert will make $262 million in that period while playing for his new coach Jim Harbaugh. Lest you think it must have been super-agents who wrangled these massive deals…Raven QB1 Lamar Jackson negotiated his own 5 year $260 million deal

This is hardly a quarterback or NFL phenomenon, athletes across several sports are at the center of the lifestyles of the rich and famous.

Designated hitter and pitcher Shohei Ohtani a.k.a. “Shotime” inked a $700 million, ten-year deal last year with the LA Dodgers. Yankees slugger Aaron Judge makes $40 million a year or roughly $1 million per homer. Jaylen Brown with the Celtics is topping $60 million per and Nikola Jokic has a five-year $272 million deal with the Nuggets.

This immense wealth creation for athletes hasn’t been at the expense of the oppressive owners…sports franchise values have blown the roof off over the past couple of decades. The Brooklyn Nets were purchased in 2010 for $223 million and are worth $3.5 billion today. Jerry Jones bought the Cowboys in 1989 for $150 million and the team is valued at $9 billion today. George Steinbrenner bought the New York Yankees fifty years ago for $10 million and today are valued at nearly $7 billion.

TV has been the gas fueling the sports revenue engine for years, with 70% of Americans watching live sports. Football is the dominant TV sport with it capturing all 10 of the most watched programs. The sport is made for TV with 3-hour runtime but the in-game action itself lasts about 11 minutes…plenty of time for commercials. This year’s Super Bowl drew a record 115 million viewers. Even the NFL Draft had 55 million people tune in. That’s 9X the average viewership of 60 Minutes.

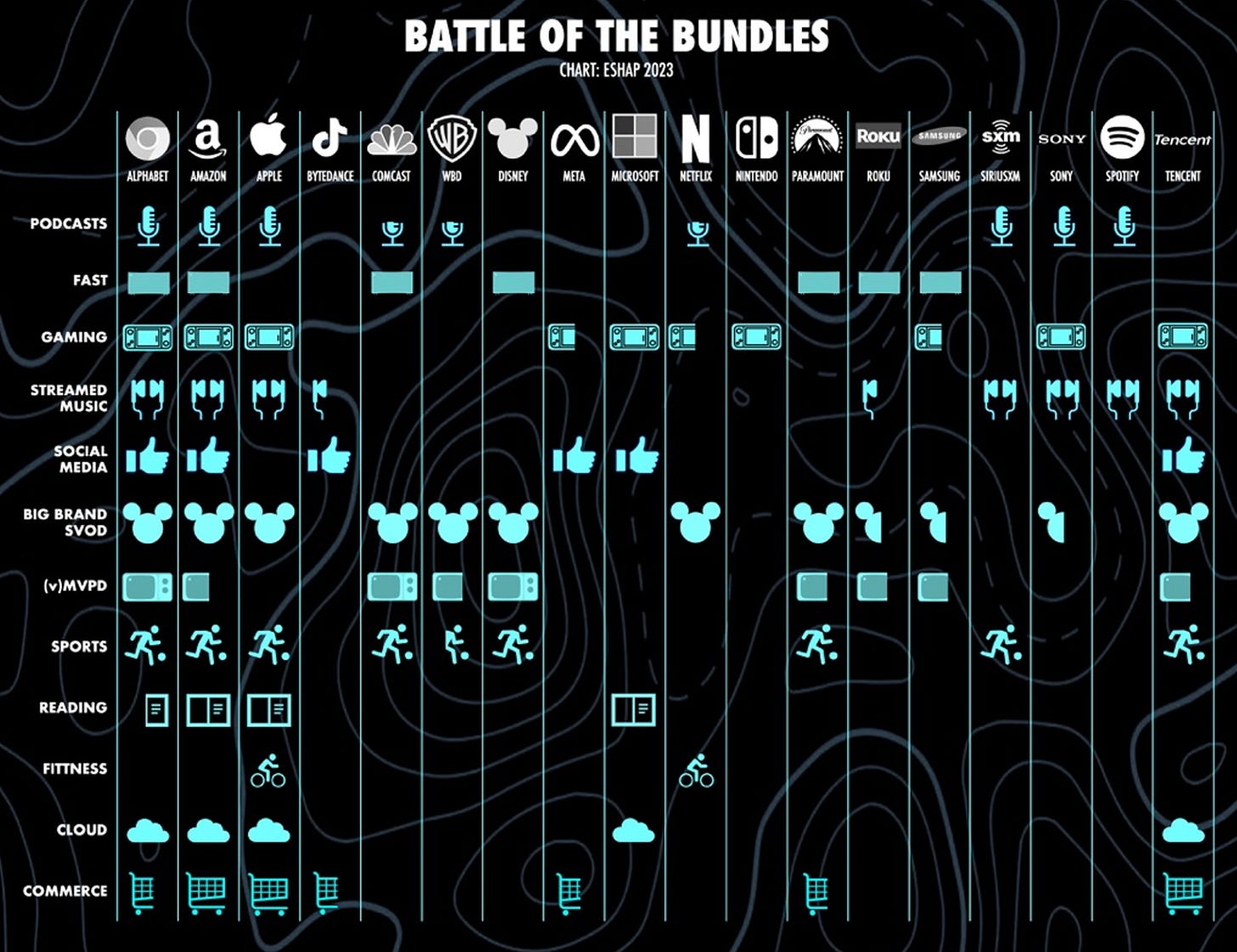

A massive, engaged audience means big bucks. The most recent NFL TV deal package is worth over $100 billion from 2023 until 2033. Amazon is paying $1 billion annually just for Thursday Night Football streaming rights. 70% of fans say they will switch TV providers to maintain access to the sports they want to watch. The indifference to network coupled with increasing streaming services means it's likely Big Tech will become the dominant sports channel in the future.

The megatrends of globalization, social media, and mobile communications create additional tailwinds for sports and the stars who play them.

This past season, the NBA had 125 foreign players from 40 different countries. The NBA plays preseason games in Paris, Mexico City, Madrid, and Abu Dhabi. It’s further extending its global reach with its joint venture in the Basketball Africa League. The NFL plays regular season games in London and Frankfurt and the Super Bowl is the second most-watched sporting event with FIFA’s World Cup at #1 with 1.5 billion viewers.

Athletes have been influencers going back to multi-athlete star Babe Didrikson Zaferias being a sponsor for Dodge following her two gold medals in the 1932 Los Angeles Olympics. In the late 1950s, Arnold Palmer created a whole new industry with his pal Mark McCormick where his sponsorship earnings vastly exceeded what he made from playing golf.

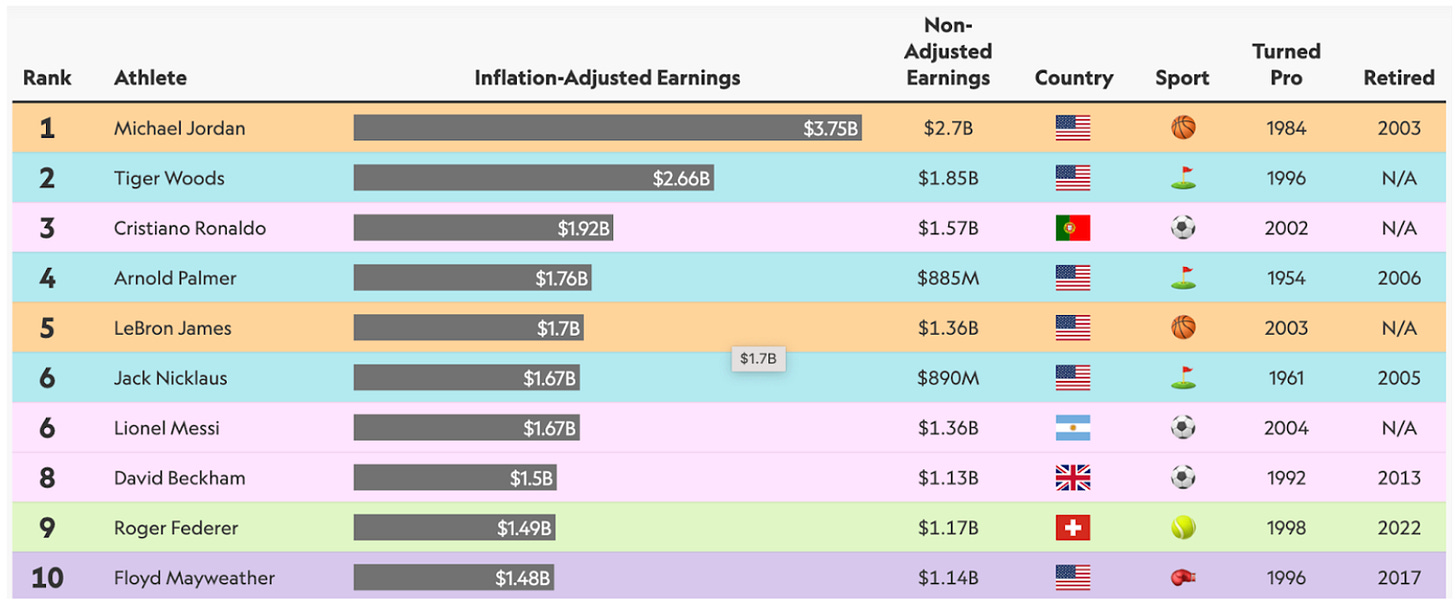

Michael Jordan is the World’s wealthiest athlete propelled by his ubiquitous and influential Air Jordan partnership with Nike, ownership in sports franchises, and of course “Be like Mike” Gatorade commercials.

If TV is gas for the sports money engine, social media is rocket fuel. With his global audience of 600 million people, it’s estimated that soccer superstar Cristiano Ronaldo earns $3.2 million per Instagram post equating to over $50 million per year. Leo Messi is estimated to make nearly $2.6 million per post.

The Supreme Court made a ruling in 2018 that made it easier to gamble with 37 states and the District of Columbia permitting it. Naturally, this further increased fans’ interest in sports. Mobile apps like Fan Duel allow you to place a bet while you are waiting for the elevator. This has particularly impacted Gen Z men, with nearly 25% view gambling as a form of investment.

While the growth in sports gambling increases engagement, it also increases the risk of fixing games. Just last week, the U.S. pulled off an Earth-shattering upset victory over Pakistan in cricket. When I was discussing the match with my Karachi-born taxi driver, he insisted it must have been rigged.

As we look at a World that is changing faster than ever before with AI disrupting everything, I believe sports will be one of the most visible places for ongoing opportunity. Yes, for the athletes, but also for the passionate fans who root for them, and for the innovators who drive value in the ecosystem.

P.S.

Congratulations to my buddy Skip Holtz who achieved a “threepeat” by winning the UFL Championship tonight. Watch the podcast we did with him last fall. Giddyup!

Market Performance

Market Commentary

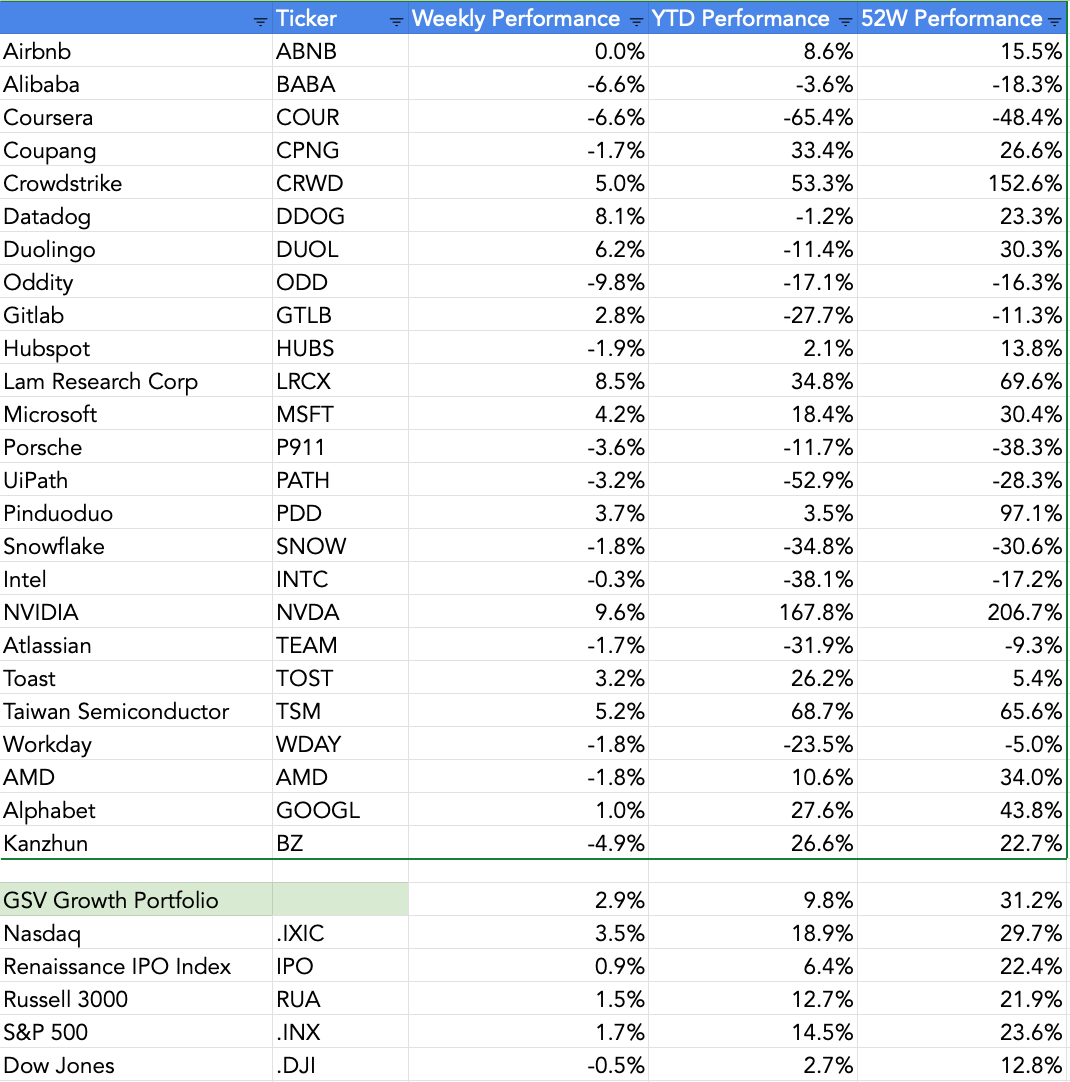

Stocks continued their steady climb last week catalyzed by Apple finally announcing its AI game plan at its World Wide Development Conference.

For the week, NASDAQ advanced 3.2%, the S&P 500 increased 1.6% and the Dow fell .5%. YTD, NASDAQ is up 17.8%, the S&P is up nearly 14% and the Dow is up 2.4%.

Other data points influencing the Market included CPI which came in slightly tamer than expected at 3.3% year-over-year. Interest rates on the 10-year note fell to 4.2% and also interesting was that China issued a 50-year bond at 2.5% yield. Consumer sentiment fell for the third month in a row measured by the University of Michigan’s CSI to 67 and below the 72 forecast.

While we’ve been encouraged for much of the year seeing a broadening of the participation in Market upside action, last week narrowed to the Big Tech names. Apple advanced nearly 8% last week, NVIDIA was up 9% and Microsoft increased over 4%. Apple’s huge week put it ahead of Microsoft to regain the title of the largest market value company in the World.

With the 10 largest companies on NASDAQ representing nearly 37%, moves of those megacaps will have an oversized influence on the index’s performance. With the current forward multiple on the S&P 500 of 21X forward earnings, we think the best risk-adjusted opportunity will be with an emerging growth portfolio. Moreover, we expect to see a continued opening of the IPO Market which will provide fresh oxygen for growth investors such as ourselves.

Maggie Moe’s GSV Weekly Rap

GSV Model Portfolio

Need to Know

WATCH: The San Francisco Giants “Idea Man” - Pat Gallagher | Going Deep by Dash Media

READ: Where Have All the Short Sellers Gone? | The Daily Upside

READ: Apple's AI Challenger Sale | Tomasz Tunguz

LISTEN: Vinod Khosla on What to Build in AI | More Or Less

READ: The Ozempic Effect | The New Statesman

READ: The Future of AI is Vertical | Euclid Insights

GSV’s Four I’s of Investor Sentiment

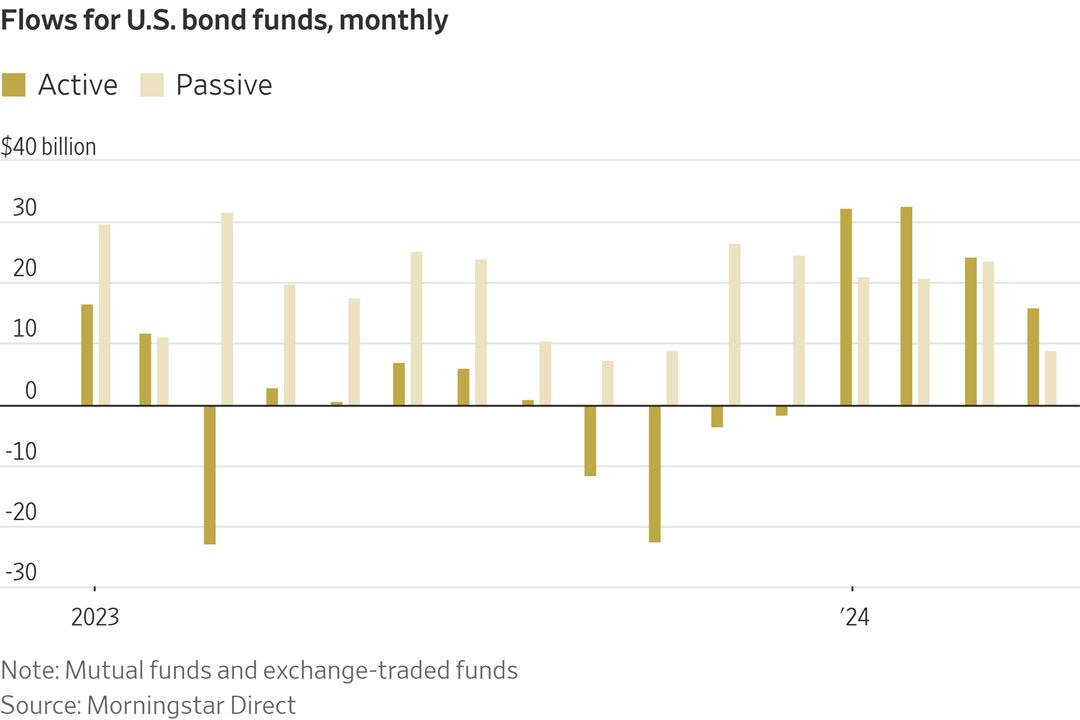

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Daily Chartbook

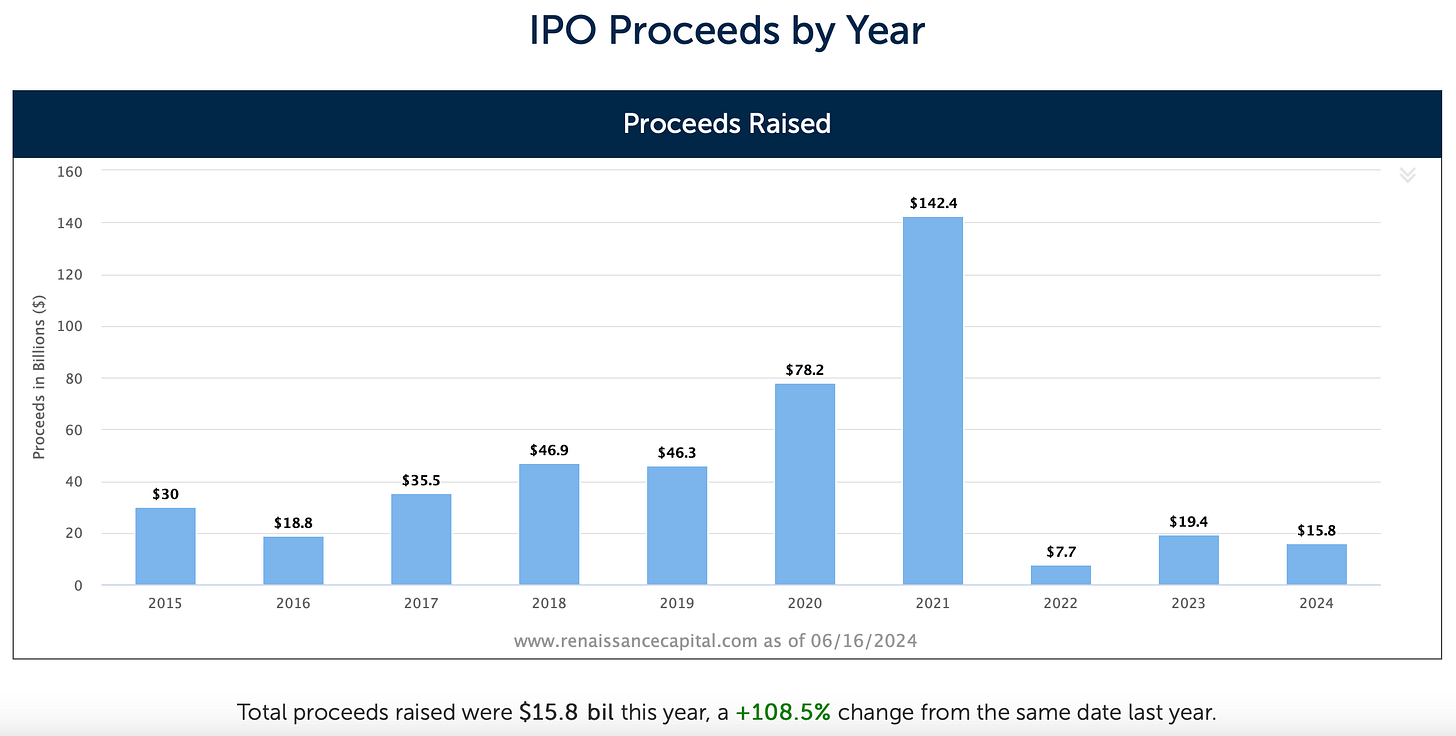

#2: IPO Market

Source: Renaissance Capital

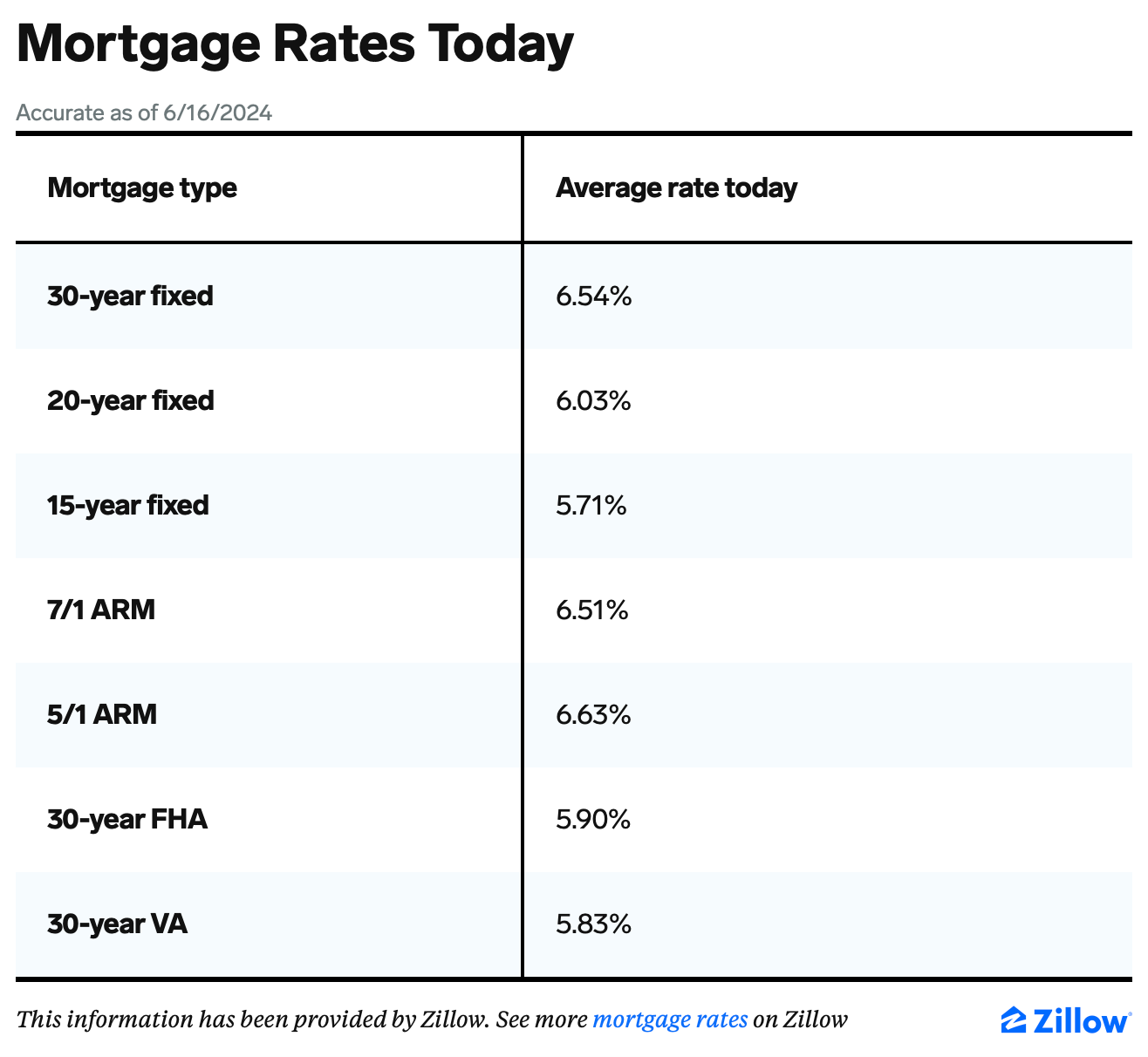

#3: Interest Rates

Source: Business Insider

#4: Inflation

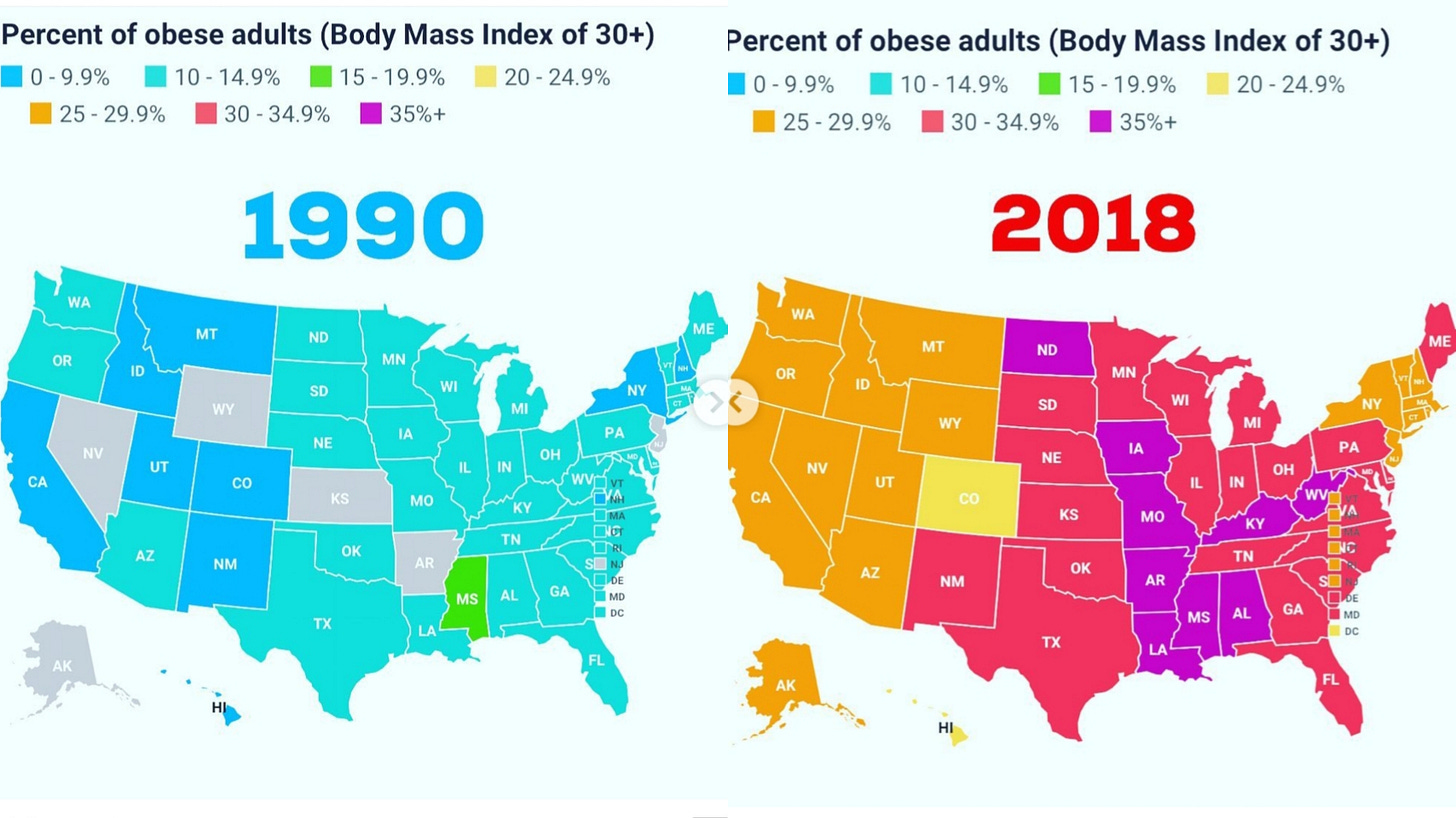

Chart of the Week

H/t: Justin Mares

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: $600-700 million – the amount of revenue Mr. Beast brings in annually (TIME)

Innovation: 97% – The share of real estate investors, developers and operators who plan to increase their investment in data centers this year (CBRE)

Education: 50% – The percentage of Americans with low financial literacy who say they “don’t have sufficient savings to cover 1 month’s living expenses, compared to 10% of those with high financial literacy (Global Financial Literacy Center)

Impact: $32 million – the total amount that the island nation of Anguilla earned in 2023 from .ai web domain registrations, more than 10% of its GDP (The New York Times)

Opportunity: $11,600 – the average cost of childcare per year in the United States (Scott Galloway)

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM