GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

Today’s EIEIO is brought to you by Growth School

LinkedIn isn’t just a social platform—it’s a goldmine when you combine it with AI.

Vaibhav Sisinty, the founder of GrowthSchool, with over 400K followers on LinkedIn has taught 200K+ professionals how to unlock this potential.

In his AI Powered LinkedIn Workshop, for founders, entrepreneurs, and business owners he will show you how to:

👉 Automate lead generation to grow your business while you sleep

👉 Use AI to analyze large amounts of data in seconds and take informed actions

👉 Leverage AI to land high-paying jobs without wasting hours on applications

👉 Master his $100K LinkedIn Outbound Strategy to boost revenue effortlessly

But it’s only FREE for the first 100 people. After that, the price jumps back to $399.

EIEIO…Fast Facts

Entrepreneurship: 62% – The YoY uptick in 2023 in people starting new jobs as founders after being laid off from a Big Tech company (Live Data Technologies)

Innovation: 12% – The percentage of all of U.S. electric demand that will be made up by data centers in 2030, up ~4x from today (Power Engineering)

Education: 13.2% – The YoY gain in MBA applications for 2024, after trending negative four out of the past 5 years (Fortune)

Impact: 15 years – The estimated amount of time until four essential drugs (amoxicillin, cefalexin, ciprofloxacin, and cloxacillin) are likely to be lost to resistance and require replacement (Center for Global Development)

Opportunity: 42 years – The average age of operational U.S. commercial nuclear power reactors (U.S. Energy Information Administration)

“A great city is not to be confounded with a populous one.” – Aristotle

“You may all go to Hell, and I will go to Texas.” – Davy Crockett

“Football is to Texas what religion is to a priest.” – Tom Landry

If you would have bet me whether I’d ever move to Dallas pre-Thanksgiving 2020, I would have taken the under all day long.

Dallas?!

I had a lifelong bias against Dallas. And BTW, when I arrived in California in 1995, I thought I had died and gone to heaven…so why in the world would I want to live anywhere else?

To start with how I had acquired a disdain for Dallas, I was at Metropolitan Stadium in 1975 when Drew Pearson committed premeditated assault on Nate Wright robbing the Vikings of an opportunity to go to the Super Bowl. What should have been 5-10 years in jail (or at least an offensive pass interference penalty) was instead the “Hail Mary” touchdown delivered by Roger Staubach to #88.

Also adding to my prejudice was the hit show “Dallas” featuring the oil tycoon J.R. Ewing and all of his despicable ways. Who shot J.R. was only a mystery because so many people had a motive to.

Of course, Dallas was also the place where President Kennedy was assassinated so it just wasn’t a place I felt drawn to.

Alas, Covid hits, and my California Dream of 25 years turned into a nightmare. Strip clubs were allowed to be open, but churches were closed. Crime became legal and homeless people had more rights than homeowners. Up was down, and right was wrong.

Then we visited Dallas over Thanksgiving 2020 to see our youngest daughter Caroline. She had moved to the Big D with her husband and dog at the beginning of the pandemic.

We ate at the restaurants. We went to Topgolf. We attended church. It wasn’t like we were in Gotham after the Joker took over…it seemed normal.

Returning to Silicon Valley, we were struck by how different it was. We lived in the most beautiful place on earth, yet the virus made us all victims. The straw that broke the camel’s back was when my wife was hiking by herself in the middle of the Santa Cruz mountains, and someone ran over to yell at her because she wasn’t wearing a mask.

Bonnie got home from that hike and said “We’re moving.” So we became part of the Texodus movement, arriving in Dallas in June 2021.

I wanted to say the move was strategic…after all, GSV stands for Global Silicon Valley which is the idea that the mindset of innovation and entrepreneurship was spreading throughout the world. We wanted to connect Silicon Valley to this emerging Global Silicon Valley so I figured, let’s eat our own cooking. However, truth be told, we were escaping Alcatraz.

Initially, I kept my office in Silicon Valley (which I thought I would be buried in because I loved it so much), but when I returned, people were still Zooming, making the concept of the office kind of silly. More importantly, I started to realize that Dallas has the opportunity to become the hub of the future.

Whether by serendipity, planning, or providence, Dallas has the mojo.

When you look at the innovation centers that drove change throughout history, some of their attributes were leadership in education, culture, infrastructure, politics, technology finance, and geography.

Dallas has a booming higher education system with over 40 universities and 250,000 higher education students. A leader in the “Hire Ed” movement, the University of Texas at Dallas was founded by the executives at Texas Instruments. Dallas College, with its 140,000 students, is an innovative learning engine for the community. SMU and TCU both have major entrepreneurship programs and are linked in to the business ecosystem.

The city is also the home to Randy Best, education entrepreneur extraordinaire who founded Voyager, Academic Partners, and Higher Education Institutions. Dallas is an economic cluster for education innovation.

Cities boom where young, talented people want to be. Dallas has incredible major league sports with the Cowboys, the World Champion Rangers, the Mavericks, the Stars, the Wings, and FC Dallas. Ironically, Dallas is the residence of Kansas City Chiefs Owner Clark Hunt, who also owns FC Dallas…

Urban Cowboy might be what you envision when you think of the Dallas Arts Scene but it is one of the most robust and sophisticated in the country. Symphony orchestras, museums, art galleries, performing arts and theater, the list goes on…

Most surprising to me is that Dallas has one of the best restaurant scenes on Earth. Analogous to Dubai, top chefs are coming to Dallas to participate in a thriving culinary ecosystem. Smartly, the aforementioned Dallas College has a key focus area on the restaurant industry which will only add fuel to the fire and contribute to Dallas’s attractiveness.

A few standouts D-Town has to offer:

Dallas is located approximately equidistant to each coast, making it ambidextrous in its access to opportunities. DFW Airport is a major asset for Dallas’ opportunity which last year served 82 million passengers and has direct flights to almost every key city on the planet. DFW airport is larger than Manhattan, which gives it room to expand – it’s adding a new terminal in the next few years. Even Love Field, a favorite among private jet owners, has 18 million passengers per year, barely behind Austin (AUS) and Nashville (BNA).

500 years ago, you lived and worked within five miles of where you were born. Planes, trains, and automobiles made mobility much easier, but even so, 20 years ago, most new companies focused on the local market and with success, might go regional, and ultimately national. Very few would go global.

From a venture capitalist standpoint, the rule of thumb used to be if you couldn’t drive to your investment, it was too far from home. This worked great if you lived in Palo Alto and all the dynamic companies you could dream of were just down the 280 freeway.

In fact, in 2011 when we started Global Silicon Valley, 92% of venture capital was in the United States and most of that was between San Francisco and San Jose. In what has been a mega shift, last year, 60% of venture capital took place outside the U.S., and while Silicon Valley remains the King, Princes have emerged throughout 50 states.

The punchline: if the goal is to invest in the fastest-growing and most dynamic companies in the world, you need to be a global investor. To be a global investor, you need to live where there is a major international airport.

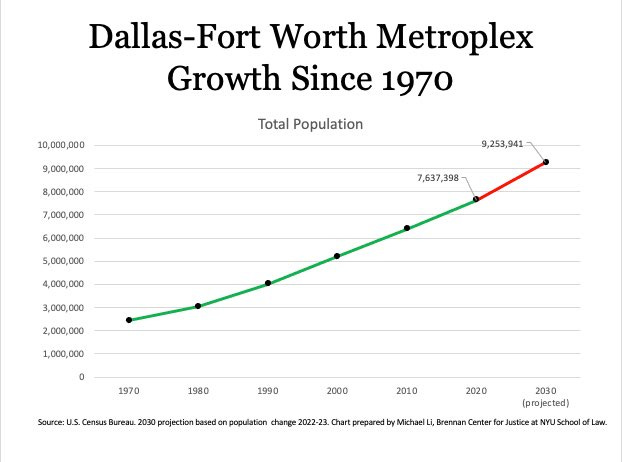

All of this has contributed to Dallas being a boomtown. It’s now projected that by 2030, Dallas will be larger than Chicago. Personally, I have a disdain for the term “Metroplex”…it reminds me of “Chicago Land” or calling San Francisco “Frisco”, but I digress. Major companies like Charles Schwab, Fisher Investments, McKesson, and Caterpillar have relocated their headquarters here in the past several years. DFW has 21 companies on the latest Fortune 500 list.

Texas Instruments was the original pioneer in the semiconductor revolution, and Dallas has the second most tech workers in the US next to Silicon Valley. Venture capital, once the dominant domain of Silicon Valley, has spread throughout the globe over the past dozen years, and Dallas has been a growing participant in this.

One of the most exciting signs of the rise of Dallas as a leader of the future is the growth in financial services jobs. There are now 385,000 financial services jobs in Dallas, second to only NYC, with 60,000 new jobs added in the past five years. Goldman Sachs is putting its second largest office in Dallas with a new $500 million, 800,000 square-foot tower.

The forthcoming Texas Stock Exchange in Dallas is another signal of the momentous shift that’s taking place from Wall Street to Y’all Street. Backed by Blackrock and Citadel Securities (among others), the TXSE is expected to be the most well-capitalized exchange entrant to file a registration with the SEC.

TXSE has raised about $120 million to take on NYSE and NASDAQ and is set to launch in late 2025 or early 2026.

It has been articulated that the exchange will have even more stringent listing requirements than the NYSE and NASDAQ. There is a major mismatch at play - the number of venture-backed businesses has skyrocketed over the past ~30 years (in 1996, the total amount of venture capital invested in the United States was $10 billion, and in 2021 that number reached $345 billion) while the number of publicly listed companies has been slashed.

It’s my belief that it is the wrong strategy to be stricter, and my hope is that it can become the home of the Stars of Tomorrow, in the sort of wild west way that NASDAQ used to be…this is a gigantic opportunity.

Add it up, and you can’t deny that something very special is happening in the Lone Star State and specifically in the Big D. Yes, it’s now the eighth-largest economy in the world and thriving. But what makes it great is that it’s a place that loves the 4F’s…family, faith, the flag, and football!

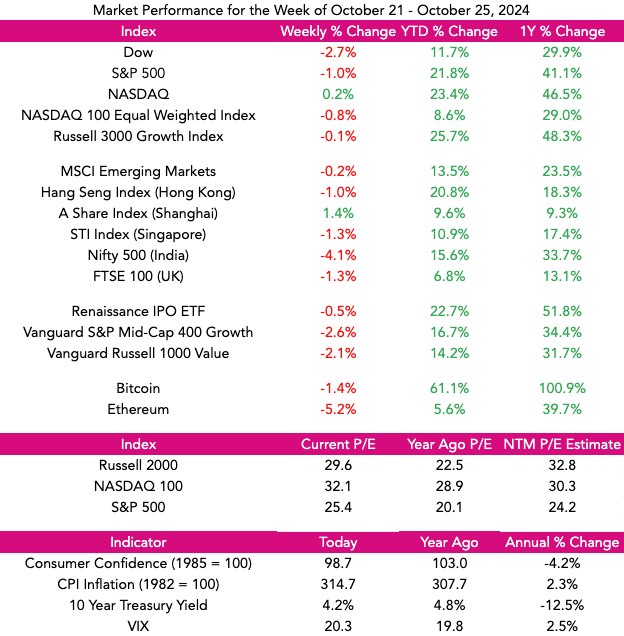

Market Performance

Market Commentary

Stocks generally took a pause last week after six weeks of positive moves. Reasons given for the break were concerns flipping from worried that the economy was too weak to it’s too strong. Yields on the 10-Year Treasury have gone from 3.6% in September to 4.24% last week.

The Dow fell 2.8% and S&P 500 dropped 1% while NASDAQ inched up .2%. Helping the NASDAQ was Tesla which rose 22% on Wednesday on better than expected results and strong guidance for 2025 from Commander in Chief Elon. Also, for a micro-second, NVIDIA was the largest market cap company in the world, reaching $3.5 trillion and surpassing Apple.

In the land of bites instead of bytes, MacDonald was impacted by an E.Coli outbreak that resulted in one death and 49 illnesses…MCD stock dropped 5%. Starbucks, led by former Chipotle CEO Brian Niccol said they “needed to get back to growth” after reporting a drop in same-store sales by 7%. Meanwhile, healthy restaurant concepts Sweetgreen and Cava are both up over 3X in the past twelve months.

We remain BULLISH on the outlook for equities and growth stocks in particular. We also believe that there will be a wave of exciting new issues that will provide oxygen for the market to go higher.

Need to Know

READ: Six-Chart Sunday (#40) – The Five Questions | Bruce Mehlman’s Age of Disruption

READ: Introducing Oboe, on a Mission to Make Humanity Smarter | Oboe.fyi

WATCH: Marc Andreessen on AI, Geopolitics, and the Regulatory Landscape | Ray Summit 2024 | Anyscale

LISTEN: Doordash ft. Tony Xu - The “Wrong” Moves That Built a Giant | Crucible Moments

ICYMI: 🎙️ Ep 28 · Alan Todd: Founder of Udemy Business Leadership Academy | Dash Media

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

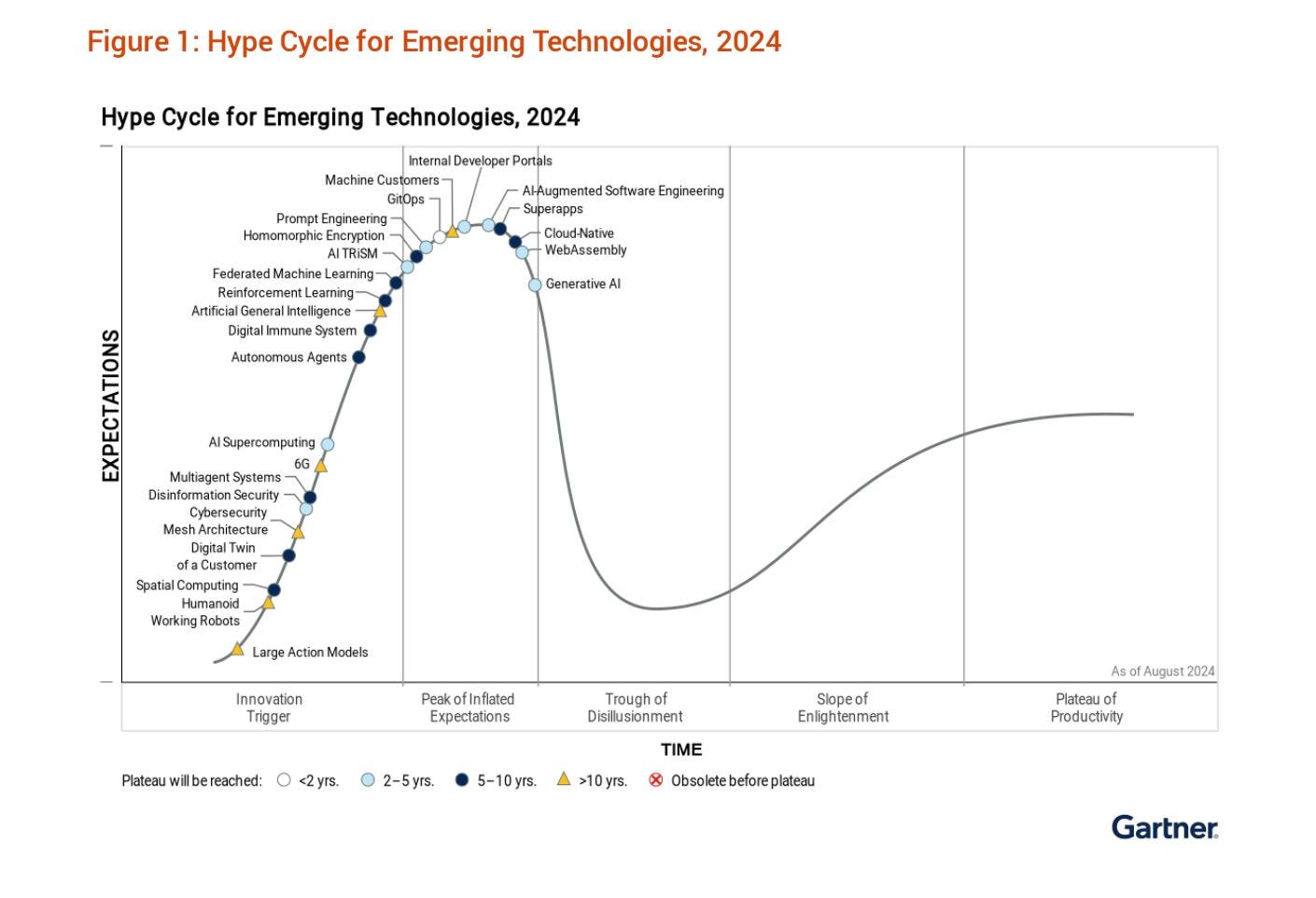

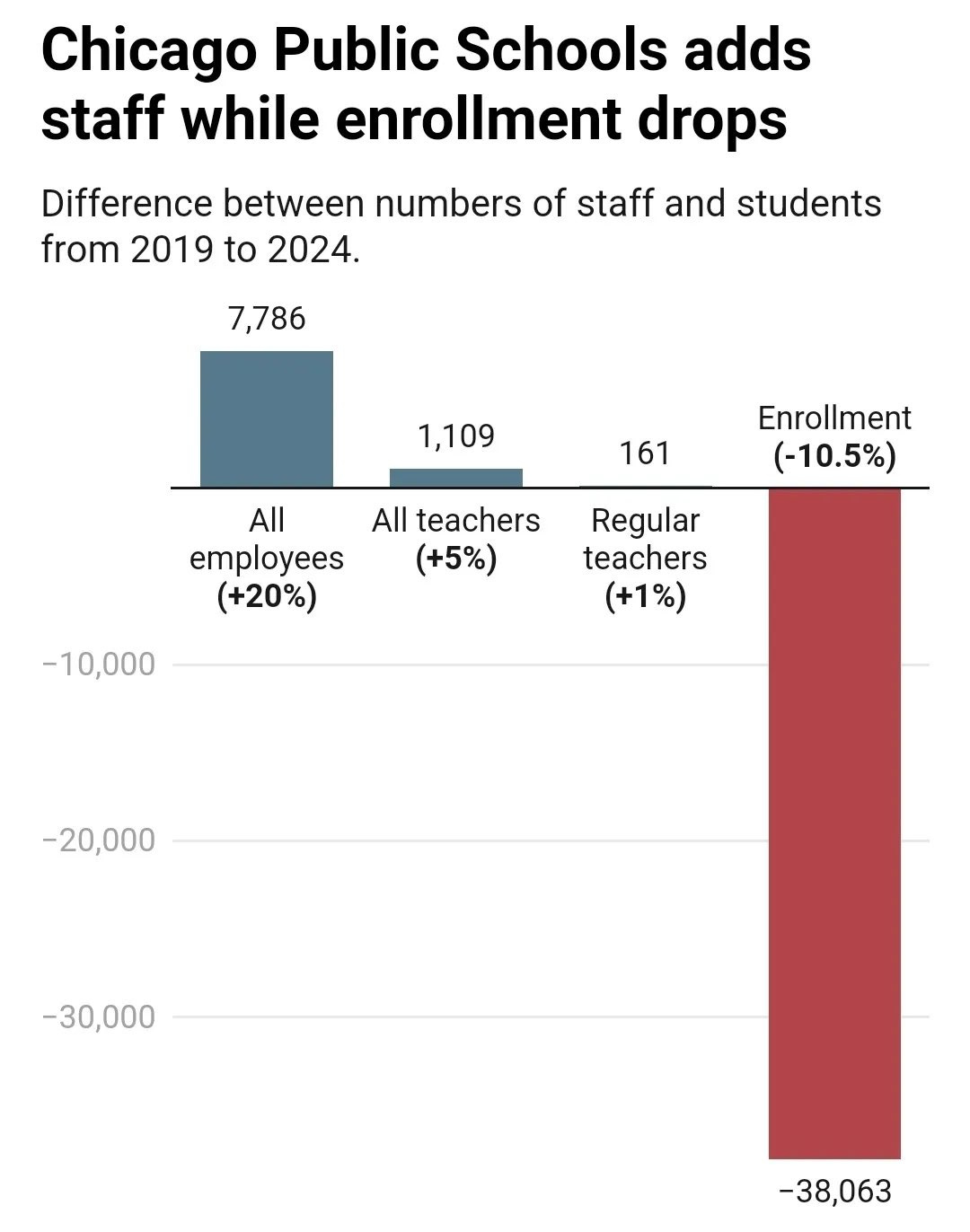

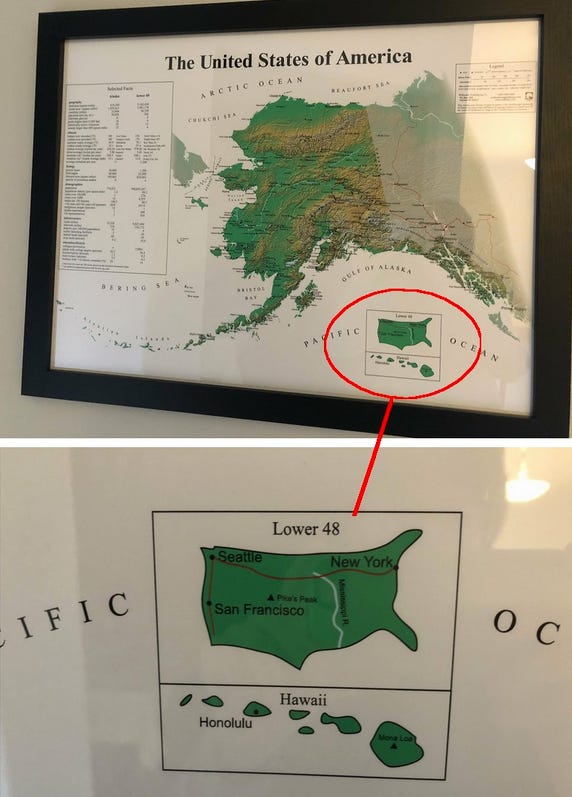

Charts of the Week

Maggie Moe’s GSV Weekly Rap

Chuckle of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM

![Thread by @analyticartist: "@ThomasS4217 @visionsurreal @timeoutofmind64 @VickerySec "The Landmark" "The Pioneer" @ThomasS4217 @visionsurreal @timeoutofmind64 @VickeryS […]" #WorldNetDaily #Infowars #functionize Thread by @analyticartist: "@ThomasS4217 @visionsurreal @timeoutofmind64 @VickerySec "The Landmark" "The Pioneer" @ThomasS4217 @visionsurreal @timeoutofmind64 @VickeryS […]" #WorldNetDaily #Infowars #functionize](https://substackcdn.com/image/fetch/$s_!WyYF!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2413d7c5-415a-4402-8039-091e5e04150b_1058x430.jpeg)

![America has lost 43% of its stocks since 1996 [OC] : r/dataisbeautiful America has lost 43% of its stocks since 1996 [OC] : r/dataisbeautiful](https://substackcdn.com/image/fetch/$s_!zRHH!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F802214c0-159c-495f-a0f0-018f5d99ea58_2052x2052.png)