GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

I’m in Gurgaon for the ASU+GSV & Emeritus India Summit, where this year’s theme is Learning at the Speed of Light. We hoped to put together a piece breaking down the market-moving DeepSeek chaos, but the 8,000+ mile end-of-week travel proved too much.

Everyone seems to have an opinion on what DeepSeek means for the AI Revolution. Are foundation models cheap commodities? Are chip makers doomed? Are they just getting started? We’ll break down our viewpoint in a future installation, but today, we want to rewind to one of our best-received pieces of 2023: EIEIO…Chips Ahoy!

Hopefully, this provides some context on AI’s hardware layer and a few geopolitical implications that come with it. Enjoy.

– MM

EIEIO…Fast Facts

Entrepreneurship: 50% - The percentage of Y Combinator W24 companies that are building with AI. (Crunchbase News)

Innovation: 1 - The number of times a civilian jet has ever broken the sound barrier – this resulted from a successful test flight by Boom Supersonic’s XB-1 on Tuesday, in which the aircraft reached speeds of roughly 750 miles per hour. (CBS News)

Education: 67% – The percentage of US 8th graders who scored at a basic or better reading level in 2024, the lowest share since testing began in 1992. (Fortune)

Impact: 1 billion – The number of hours streamed per day on YouTube TV in 2024. (Yahoo! Tech)

Opportunity: 1/8 - The portion of NYC public school students who were homeless in 2024, up 23% year over year (Advocates for Children of New York)

“The chip rush is bigger than any gold rush that has ever existed.” – Elon Musk

“For fun, our firm has an internal game of what public companies we’d invest in if we were a hedge fund. We’d put all our money into Nvidia.” – Marc Andreessen, 2016

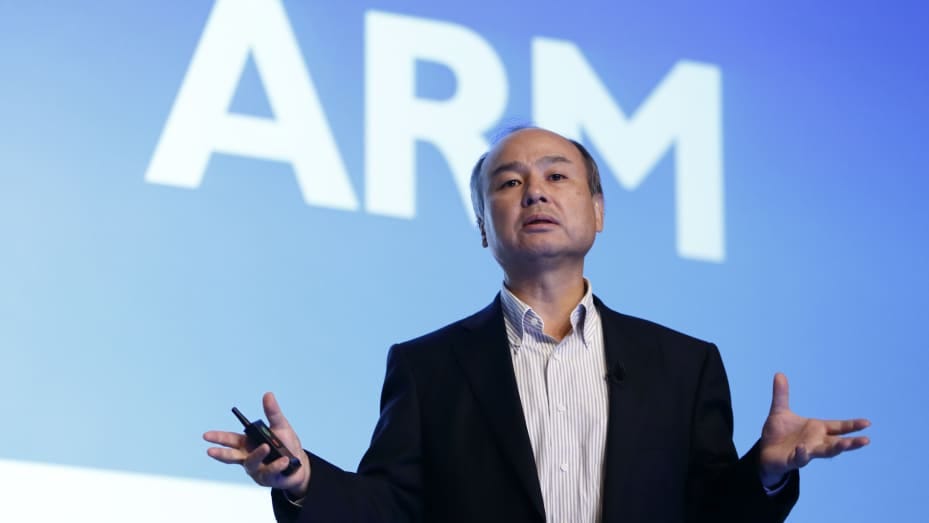

“I would say that hardware is the bone of the head, the skull. The semi-conductor is the brain within the head. Software is the wisdom. And data is the knowledge.” – Masa Son

The following was published on Dash Media on March 3, 2024

“Here’s a life tip: if someone called Masayoshi Son comes knocking on your door offering to manage your money any time soon, don’t let him. In fact, call the police and ask them to escort him from the premises.” - The Information, May 2022

Fast forward to today. Masa – who you were supposed to call the cops on for offering to manage your money – currently holds a massive position in Arm, a Cambridge, UK-based semiconductor designer. He bought Arm for $32 billion in 2016, and it’s now worth $132 billion.

Some call Masa a Riverboat Gambler, recklessly throwing down chips on whatever is catching his fancy at the time. The record suggests that he has an uncanny ability to see the future way before the average mortal. And he’s willing to put his money where his mouth is.

Vinod Khosla has a quote on the good news about venture investing: “You only lose 1x your money if you fail, but if you succeed, you can make 100x.”

Masa sings from the same hymnal.

He was an early investor in Yahoo when everyone still thought it was a chocolate drink. His $20 million investment in Alibaba in 1999 before people knew how to spell Jack Ma’s name returned $72 billion over the next 23 years.

Venture Capital is a Power Law business. It only takes one winner and the conviction to hold onto it…and Masa has been stacking chips for a long time.

Whether it’s Arm, NVIDIA, or others, one thing is for certain: semiconductors are the foundational building blocks for AI computing…and the 21st century.

It’s 1777 in the AI Revolution. The question is, who is going to arm it?

First Draft Pick: NVIDIA

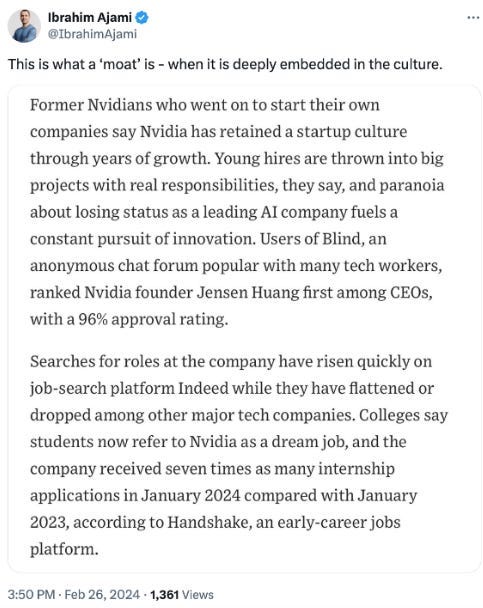

It’s a 31-year-old overnight success story. It was the best-performing stock in 2001, 2016, and 2023. Even with 30,000 employees, they operate with startup-like efficiency and dedication to innovation. CEO Jensen Huang is also known for his unique management style, with 50 direct reports.

This culture has yielded results, and the data suggest they should expect to continue winning the talent wars.

What the casual observer may not realize, though, is that Nvidia does not make chips. They design them. And they design them well. Their most recent data center GPU is 6x faster prior than their formerly ground-breaking release.

Across the Pacific, Taiwan Semiconductor Manufacturing Company (TSMC) manufactures 90% of Nvidia’s chips (and has a 90% market share in advanced semiconductors globally).

Nvidia has been beloved by gamers and crypto miners for a long time - because of its cutting-edge graphics processing units (GPUs) that offer exceptional performance, efficiency, and versatility for a wide range of applications. Crypto miners particularly favored NVIDIA due to the GPUs' computational power, which is crucial for mining Bitcoin and Ethereum, making them the preferred choice during crypto run-ups in the 2010s.

However, NVIDIA shifted its focus towards AI technologies all the way back in 2006, positioning itself as a leading AI company with applications in various industries. It was 18 years ago that NVIDIA released its Compute Unified Device Architecture (CUDA) platform, a major innovation in GPU-based parallel computing technology.

Nvidia was prepared, and when the AI Boom officially arrived with the release of ChatGPT on November 30, 2022, it pounced. Consider this mind-blowing statistic: Nvidia’s $47.5 billion in data center revenue this year is 18% more than total data center revenues for the past five years combined – Nvidia generated $40.2 billion in DC revenue between FY18 through FY23.

The expansion of Nvidia's Data Center revenue is the leading indicator for the AI Revolution…and all signs suggest that the race is on.

China and Taiwan

90% of advanced chips are manufactured by TSMC on the island of Taiwan. TSMC counts giants like Qualcomm, Apple, AMD, Broadcom, and of course Nvidia, as clients. TSMC chips are used in vehicles, weapons systems, and medical devices.

Despite Taiwan being governed independently since 1949, China claims that the island nation is part of its territory.

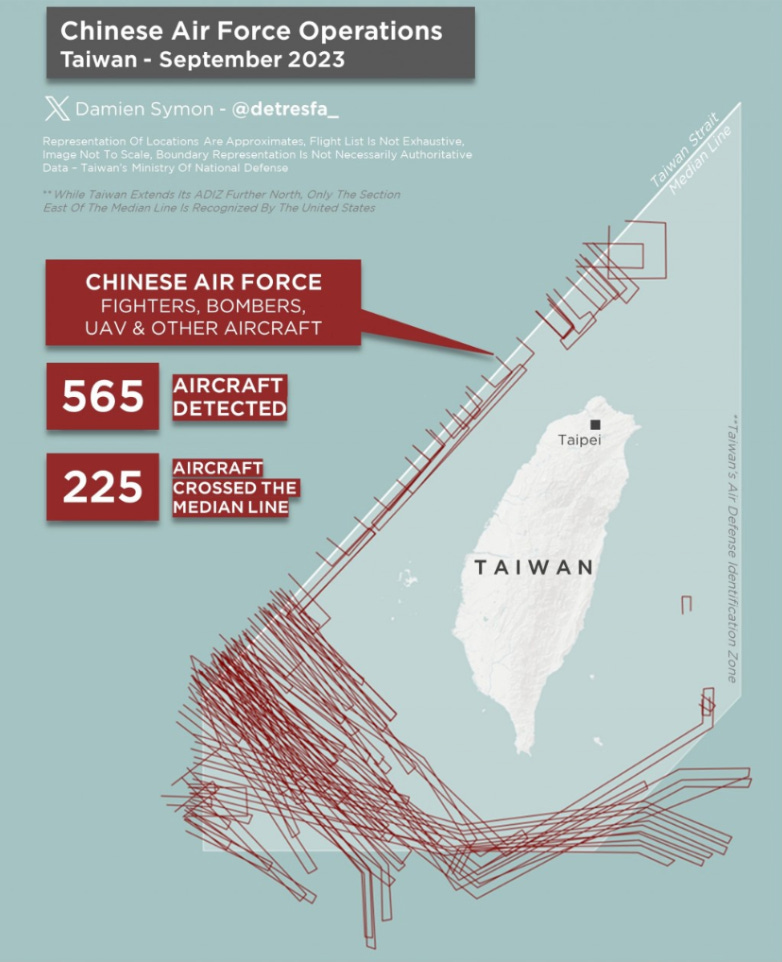

You don’t have to be Henry Kissinger to understand why these are dicey circumstances. China’s increased assertiveness has been demonstrated in the form of incursions into Taiwan’s Air Defense Identification Zone (ADIZ). Bloomberg Economists estimate that a Taiwan war would cost roughly 10% of global GDP and catalyze a global depression.

While Hakuna Matata would be a more convenient philosophy, the reality is that most experts expect a Chinese-Taiwan confrontation at some point. The consequences of that are nothing short of catastrophic for the global economy.

As CJ Muse from Evercore puts it, “The biggest risk is US-China relations and the potential impact to TSMC. If I’m a shareholder in Nvidia, that’s the only thing that keeps me up at night.”

This article from the Council on Foreign Relations sees a conflict occurring anytime from this decade to 2049. We don’t have to rely on strategists; we can take Xi Jinping at his own word, who talks about the reunification of China and Taiwan no later than 2049…the Chinese Dream.

The Chinese Dream is the American Nightmare. While the USA was asleep for too long and in an unacceptably vulnerable position, it finally woke up appropriately scared.

CHIPS Act

America invented semiconductors.

30 years ago, 40% of chips were made in the US…today, less than 10% are made here.

Today, TSMC has a 90% share of high-end chips which makes Xi’s Sabre Rattling…rattling.

The United States passed the CHIPS Act in August 2022 to provide federal funds to assist the onshoring efforts associated with chip production. It’s proven especially timely given the AI Bonanza started just 4 months later…and has no end in sight.

The act provides $52 billion in upfront funding to accelerate the development of a domestic supply chain for semiconductors...and reduce the US’s reliance on international supply lines. The most important resource in the World is something that the US ultimately does not control and cannot manufacture within its own borders (as of now).

Semiconductor facilities are being built across the United States, but notably, they’re outside traditional technology hotspots such as Silicon Valley, New York City, and Boston. Texas, Ohio, Upstate New York, and Arizona are emerging as key hubs, with the help of federal funding.

These companies are all partnering with local universities to develop the human capital required to power the industries of the future. Netherlands-based ASML invested several hundred million euros to build a research institute with the Eindhoven University of Technology. The partnership will support 500 researchers and 40 new PhD students per year.

In the US, Phoenix in particular is becoming a “chip capital,” led by the innovative efforts of Arizona State University. ASU went “all in” on semiconductors as a future growth industry well before its peers, and has been rewarded accordingly.

An FT report found that of the $242 billion that has been invested in American chipmaking since 2003, more than $60 billion has been invested in Maricopa County since 2020. ASU is creating opportunities for its 30,000+ engineering students right in its backyard.

ASU’s efforts show the importance of human capital in being able to invent, innovate and design the chips to power the future.

To understand the dynamics that led to our precarious position we’re in, Exhibit 1 is the story of Morris Chang, the Founder of TSMC.

Morris Chang studied, lived, and worked in the US for 30 years, but realized that the future of advanced manufacturing appeared was going to be in Asia. Labor there was faster, cheaper, and better.

The massive opportunity for the CHIPS Act is twofold…. (1) recruiting the World’s All-Stars and bringing them to the United States (the next Jensen Huang and Morris Chang), and (2) training and retaining an entirely new category of middle-class manufacturing jobs in the US.

Notably, this does not include spending more time coding…as Jensen Huang just said that kids shouldn’t learn how to code. Instead, human capital can be freed up by AI to tackle these higher-order issues.

It’s been forecasted that over 1.4 million new semiconductor jobs could emerge in the US between now and 2030…and those projections were before the AI explosion.

This is a major opportunity for universities and others to address this huge demand imbalance.

One company to watch in this emerging industry is TAP (aka Training All People) (Disclosure: TAP is a GSV Ventures investment). TAP was founded by Jason Spyres, a former Palantir engineer and Stanford CS student. Before that, Jason began his “career” selling cannabis, for which he received a 15-year prison sentence.

We need to turn prisons into prep schools. Training people to work in industries shaping the future of the world (like semiconductors) will provide them with the skills they need to thrive and build a better path forward.

TAP’s mission is to provide next-generation technician training for the semiconductor industry using immersive learning (including AR, VR, and XR). TAP’s coursework is dramatically more effective, engaging, and entertaining than your standard workforce development course. It feels as fun as Lego Star Wars while learning the ins and outs of how to operate at a fab.

TAP is a win-win for both employers and students. Employers get a pool of highly skilled technicians at a scale and speed that’s dramatically better than the industry standard…at a fraction of the cost. Students get the opportunity to pursue a middle-class lifestyle and the American Dream, in a rapidly growing and dynamic industry.

For all the talk about AI eliminating jobs, this innovation is creating a massive new industry…one that doesn’t require you to have a college degree or live in a major city. The semiconductor industry could be just as revolutionary for America’s middle-class workforce as Henry Ford’s assembly line.

Scientific advancements and human ingenuity in chips will power changes in healthcare, space, digital currency, education, transportation, and homes...the ability to go where no man has gone before (literally and figuratively).

Importantly, man and machine are required to power this next computing cycle. AI needs human ingenuity and knowledge to flourish as an industry…unlocking the potential of human capital will be more important than ever in the AI era.

Just like the Gold Rush, we’re not sure if those trillions will flow to the miners, the Levi Strauss’s of the World, or the real estate tycoons. But we are sure that there will be thousands of startups, millions of middle-class jobs, and legendary companies created in the process.

Giddy Up!

Market Performance

Need to Know

READ: DeepSeek FAQ | Stratechery

WATCH: XB-1 First Supersonic Flight | Boom Supersonic

LISTEN: Mark Pincus - Product Instincts: “Proven, Better, New” | World of DaaS

GSV’s Four I’s of Investor Sentiment

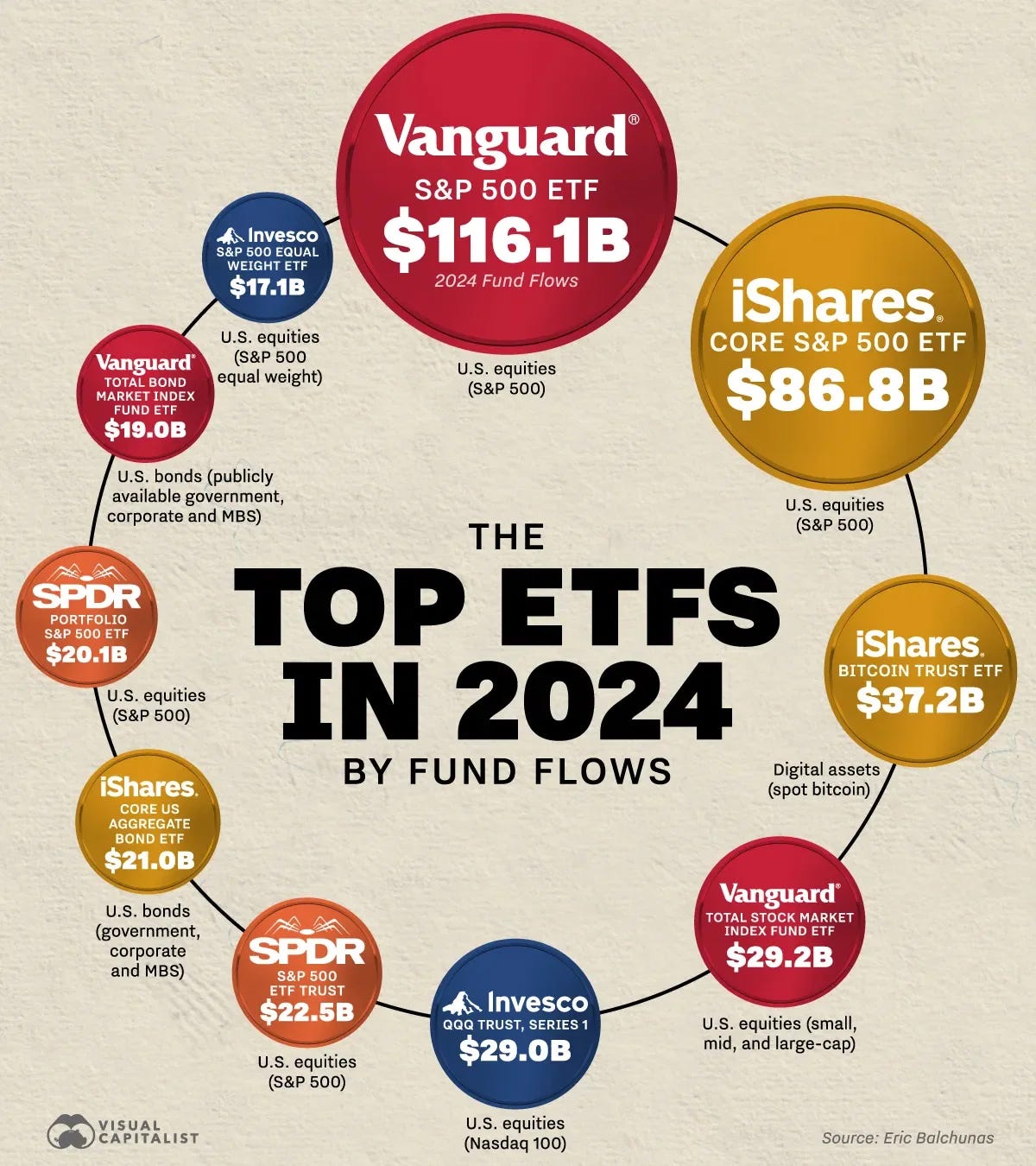

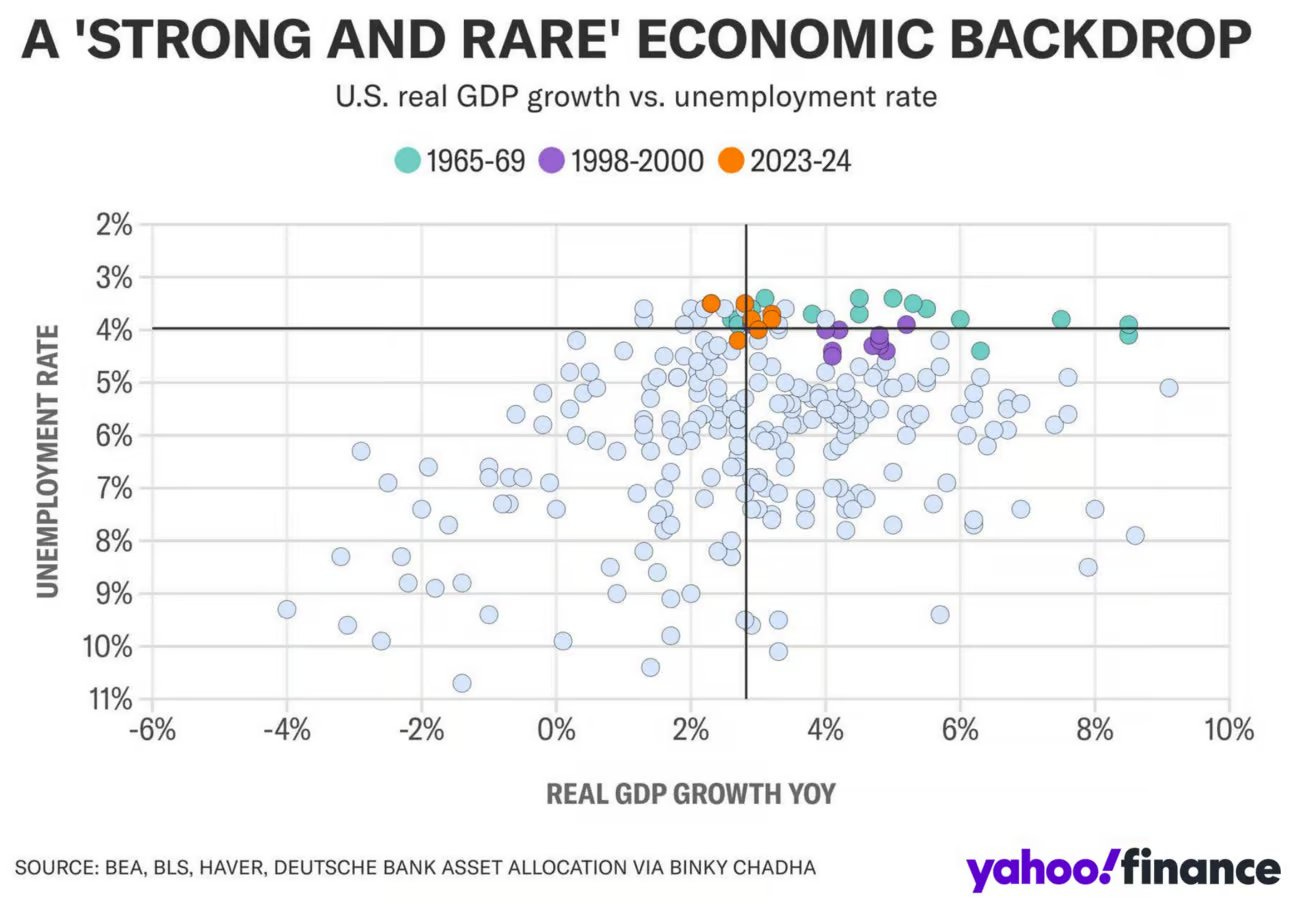

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Charts of the Week

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM