“You can't connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future. You have to trust in something - your gut, destiny, life, karma, whatever.” – Steve Jobs

“Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window.” – Peter Drucker

“Science has not yet mastered prophecy. We predict too much for the next year and yet far too little for the next 10.” – Neil Armstrong

“There is nothing like a dream to create the future.” – Victor Hugo

“He who can see three days ahead will be rich for three thousand years” – Japanese Proverb

“You can’t escape the responsibility of tomorrow by evading it today.” – Abraham Lincoln

“Only you can control your future.” – Dr. Seuss

2025 started with a level of optimism that was infectious.

You could feel it in your bones. You could see it in people’s eyes. You could hear it from small business owners.

America was back.

We had been living in a country where crime had become legal, money ruled over merit, free speech was under Pravda rules, and right was wrong.

The “black ass” contagion accelerated by a global pandemic that created the general belief that the USA was evil but thankfully in decline, the World was going to hell in a handbasket, and our kids had a hopeless future had been eradicated.

The spell had been broken.

Sure, the stock market showed the strongest post-election performance since Ronald Reagan was elected Commander-in-Chief in 1980 — but it was more than that.

President Trump’s rise from the ashes following an FBI raid on his Mar-a-largo home, four indictments, and two assassination attempts showed grit and determination of historic proportions. But the “Miracle” moment (as in the 1980 USA Olympic Hockey Team) was when the now #47 rose up with fist clenched after being shot with blood dripping down his face and shouting “Fight! Fight! Fight!” It was an inspiration to us all…even those who disagreed wholeheartedly with his policies.

Surprising to at least the chattering class was that the King of Chaos actually helped catalyze a sense of order, not just in America but around the World. The feared new “Axis of Evil” plus 1 — a.k.a. Russia, North Korea, Iran plus China — disintegrated.

President Xi’s surprise attendance in D.C. for the President’s inauguration sent a clear message the emerging Cold War between the two global superpowers was thawing.

Iran, which became an island that nobody wanted to visit, collapsed having no popular support and no money…the United States shutting off the oil spigot from Iran to the World took care of that.

With Iran rendered irrelevant and its nefarious beneficiaries Hamas, Hezbollah, and Houthis impuissant, relative peace came to the Middle East. Along with that, the Abraham Accords that created a bridge between Israel and the UAE, Bahrain, Sudan, and Morocco in the Fall of 2020 reopened and extended to Oman and the Kingdom of Saudi Arabia.

In aggregate, this resulted in a BOOM in activity making the region a hotbed for investment and partnerships. Abu Dhabi and its little brother Dubai were not just the “Capital of Capital” but the HUB for connecting the roaring economies of India, Africa, and the rest of MENA.

Our neighbor to the North had been spooked by tariff talks and Canadians such as Shark Tanks’ Kevin O’Leary advocated for Au Canada to become America’s 51st state. While Justin Trudeau didn’t become a “governor”, hockey superstar Wayne Gretzky did become Canada’s 24th Prime Minister (OK, that didn’t happen but it would have been cool).

Longtime friend India continued to not be exclusive in its relationship with us, having both reinforced its ties to Russia and literally mending its fences with China. To wit, India’s Defense Minister’s remark about its Russia friendship being “deeper than the deepest ocean.” Moreover, in settling its territory dispute in the Himalayas, China, which already was India’s biggest trading partner, accelerated.

Domestically, the new Department of Government Efficiency (DOGE) co-led by Elon Musk and Vivek Ramaswamy, brought a level of accountability to “the Swamp” – not just to make fun of the $1,000 hammers taxpayers were paying for – but also driving ROI on the $7 trillion the government spends every year. The level of talent that was brought to Washington inspired by DOGE helped prove the skeptics wrong with trillions taken out of the federal budget.

Elon’s relationship with President Trump…first as a major campaign contributor, then as a relentless advocate, next being appointed as a leader of DOGE, semi-resident of Mar-a-Largo, and ongoing close advisor; had opponents question the appropriateness of the relationship, its sustainability, and its authenticity. Reminding some familiar with the history of the relationship between FDR and Joe Kennedy provided a useful analog (Kennedy, then one of America’s wealthiest people, was a major contributor, campaigner, key advisor, and first SEC Commissioner for FDR’s Presidency). Regarding this appointment, FDR famously said, “It takes a thief to catch a thief.”

Despite the two years prior having the stock market proxied by the S&P 500 up over 20% each year (the strongest two-year performance in half a century), the market advanced over 20% in 2025 as well. While the forward P/E at the beginning of January was a historically rich 24X projected 2025 earnings forecast, driving stocks above median market performance were: 1) strong 15%+ earnings growth 2) falling inflation and interest rates making future earnings more valuable 3) a broadening in participation amongst small and mid-size stocks. Accordingly, the strongest performance of the various indices was the Russell Growth 2000.

Providing more fresh oxygen to the U.S. Markets was robust IPO activity feeding off of the 1,200+ VC-backed Unicorns that investors were hungry for and the liquidity desperately needed by the venture capital community that had been in a distribution desert for nearly five years. As legendary banker Sandy Robertson (who passed away in 2024) famously said, “When the ducks are quacking, you feed them.” Public institutional investors were quacking for fast-growing, emerging technology companies in 2025.

“Must own” IPOs for top growth investors included Stripe, Databricks, Discord, Chime, and Starlink.

India continued to be a rising star in the global economy and capital markets. GDP growth was once again 7%, which helped support Indian stocks that rose over 20%. Already the second largest stock exchange globally with $5 trillion of market value (US exchanges are $50 trillion-plus), India is on pace to be the third largest economy in the World by 2027.

A confluence of factors propelled India’s ascension on the World stage. Prime Minister Narendra Modi in his third term provided stability to programs initiated over 10 years ago and his global popularity, with 69% approval, makes him the most popular leader on Earth, giving additional oompf to his priorities. India remains the “back office to the World” but also, its burgeoning consumer class and digital economy provide additional tailwinds. Savings through retirement accounts with significant new capital going into public equities was an additional boon and helped create a perpetual demand imbalance for stocks.

Perhaps the biggest strategic advantage is the “India Stack” which hosts the country’s digital infrastructure with open APIs, digital public goods, and payments. Vishvasya interacts with the India Stack providing “blockchain” as a service that enhances digital services across various sectors.

Nowhere on the planet was the concept of EIEIO (Entrepreneurship, Innovation, Education, Impact, and Opportunity) more embraced than with “the Golden Sparrow”. Borrowing from Singapore’s playbook, India is flourishing by prioritizing entrepreneurship and education.

After a three-year drought, M&A activity picked up dramatically in 2025, buoyed by a more stable environment from a regulatory and monetary perspective. Private Equity sponsors were intoxicated by the “animal spirits” that corresponded with the new era. Large, diversified companies got the memo that “simplification” was the order of the day and actively spun out non-strategic assets.

In notable M&A transactions in the edtech space where PowerSchool, Instructure, and effectively 2U all were taken off the public market by private equity firms, Coursera and Udemy went private as well in 2025. The Supreme Court Chevron ruling along with a more regulatory-friendly Trump Administration helped remove a major risk factor for investors in for-profit education.

“The M&A market is steadily gaining strength as sponsor activity rebounds, regulatory and monetary dynamics normalize, and corporates continue demonstrating their intention to simplify portfolios.” – Stephan Feldgoise, Goldman Sachs Co-Head of Global M&A

In 2025, innovation roared catalyzed by the continuation of the AI Revolution — a.k.a. “AIR”. Like AIR, AI was invisible, ubiquitous, and you needed it to live.

Analogous to the early days of the Internet where the action was in the infrastructure and network, the excitement in participating in the AI Revolution had shifted from infrastructure and large language models to applications. For reference, the poster boy for dot com 1.0 was Cisco whose market cap today is less than it was in 1999. Ditto AT&T. AOL, which had a $222 billion market cap 25 years ago, is roughly $2 billion today…and that’s way after it swallowed up Netscape in the shot that started the whole Internet Revolution.

As in the past, the early bird often gets the turd.

The home runs in 2025 were where AI was applied to an existing industry but its application changed the game. Amazon didn’t invent selling books or the Internet but it reimagined how you could sell books online with effectively an infinite selection of titles available. Amazon’s $2.4 trillion market cap speaks to its success.

Coca-Cola didn’t invent electricity or refrigeration but it was able to utilize both to provide a scaled product that heretofore wasn’t possible. As a result, its market cap is $270 billion as one of the most valuable brands in the World.

AI provided rocket fuel for humankind to reach its potential and purpose by creating a “time dividend” allowing people to focus on where their abilities had maximum impact while enabling learning at the speed of light. Moreover, the opportunity to isolate tasks better suited for AI while empowering people to focus on where they were most gifted and engaged provided “multiplication by division”…accelerating productivity and innovation.

Technology has been on an exponential curve but human capabilities have been growing at a linear trajectory. 24/7 tutors, just-in-time, invisible, and personalized learning…all enabled by AI-transformed education…allowed students to hop on the exponential growth curve.

Everybody had an AI agent as their own chief of staff, financial advisor, executive coach, career planner, and personal trainer. What used to be available to only the rich and famous was now as common as mobile phones.

Robots went from the warehouse to the front of the house, with restaurants such as Sweetgreen and Chipotle being the early adopters. The challenges finding workers coupled with rising labor cost were motivators. Dyson came out with a housekeeper robot that was hot, hot, hot.

Net-net, this resulted in an innovation and learning explosion…and a dramatic increase in the quality of life for many of the 8.1 billion of the Earth’s inhabitants.

Using AI for instantaneous analysis to make decisions was standard across every industry…from sports, to finance, agriculture, to health care. Even “Moneyballing Motherhood” became routine as data superseded wives’ tales for parenting.

In biotech, drug discovery and personalized medicine were radically advanced by AI. Data was the ultimate drug, with companies like Insilico Medicine going public in Hong Kong in 2025 after Eric Lefkofsky’s precision medicine company Tempus’ IPO in 2024.

The Old World is getting old. 22% of Europeans are over the age of 65 with a fertility rate of just 1.46. In Japan, 30% of the population is over 65. The fertility rate is 1.2 babies per woman. In Tokyo, there are two deaths for every birth.

Conversely, Africa is bubbling. 41% of the 1.1 billion Africans are under 15. In Nigeria, the fertility rate is 5 births per woman, and in Kenya, it’s 3.2. The three largest cities in the World in 2100 are projected to be in Africa.

As more evidence of the freight train coming, eight of the ten fastest-growing companies in the World in 2025 were from Africa. Outsized investment in infrastructure in digital infrastructure provided more juice to the already impressive growth story.

Generation Z now aged between 13 and 28 increasingly was becoming the Zeitgeist. 98% of GenZ has a smartphone and spends over 10 hours a day online. Nearly 3 hours a day was spent on social media. As should have been predictable, the Metaverse came back from the dead in 2025, seamlessly merging people's physical and online lives.

Mental Health is a big issue for GenZ and 37% of teenagers have been prescribed anti-depressants. GenZ is noticeably more anxious, and this impacts their financial lives. They prioritize making and saving money, and they invest earlier than previous generations. The return on investment of a college education continued to be scrutinized, with a growing number of eighteen-year-olds choosing a different path than a four-year degree. Learning to earn was a huge trend.

88% of GenZ plays video games, with 65% of them spending 3 or more hours a day gaming. Opportunities abound for acquiring skills and gaining knowledge by playing games…a theme we call “invisible learning”. 69% of GenZ gambled in the past year, most of that online, with nearly 20% being classified as “high risk” of becoming an addict.

While looking to “The Western Sky” you could see Elphaba played by Cynthia Erivo win her first Oscar in 2025, looking to the Eastern Sky over New Jersey, we still weren’t sure what we saw. Enemy Drones? E.T.? Close Encounters from a Third Kind?

Whatever it was, it increasingly feels like the new Space Race isn’t just outward between the USA, China, Russia, and India but also, coming at us with Earth against another Solar System or Galaxy. Space might truly be the final frontier and doing stuff on the Moon all of a sudden feels kind of small.

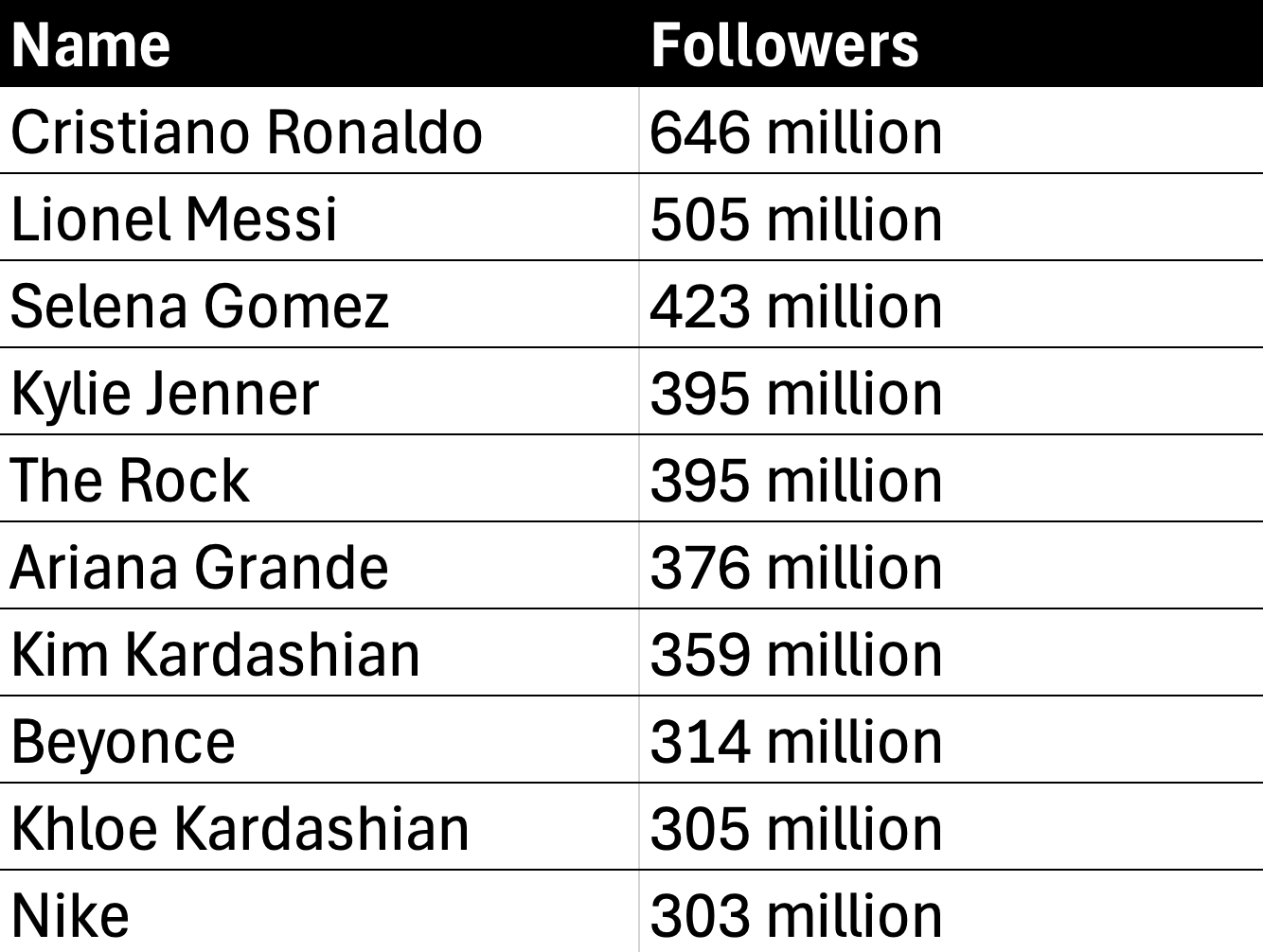

People were the new brands, whether it was in media or influencers. Joe Rogan, Tucker Carlson, and Megyn Kelly were prime examples of the former. Mr. Beast, Cristiano Ronaldo, and Selena Gomez are prime examples of the latter.

The Wide World of Sports continued to be a major area for entertainment and investment activity in 2025. Football remained King with the NFL dominating TV ratings and team values. After Arctos’ minority investment in the Buffalo Bills in 2024, private equity firms were actively trying to make more deals happen. Top of the list for PE targets was the Philadelphia Eagles – the winner of Super Bowl LIX in New Orleans.

Philly’s legendary Defensive Coordinator Vic Fangio was awarded NFL Assistant Coach of the Year with the Eagles’ defense essentially going from worst to first. In UFL action, Skip Holtz won his fourth UFL Championship in a row as Head Coach of the Birmingham Stallions.

College Sports was truly the Wild West with the Student Athlete being at risk of going the way of the Dodo bird. NIL, the portal, massive TV contracts, private equity, and sovereign funds admission to campus made the collegiate athletics of yesteryear unrecognizable. In a domino type of move, the SEC took a minority investment from Blackstone followed shortly by the Big 10 receiving an investment from ESPN. As a move considered “progress”, a $20 million per team salary cap was created for each school’s NIL collective.

Nick Saban nicknamed “Alabama Jones” as a nod to his debonair chateau on Game Day became the first Commissioner of College Football following Notre Dame winning the National Championship beating Ohio State in the expanded but flawed, football playoff.

Arts continued to influence society with the musical theater sensation My Pet Dragon bringing hope and inspiration to the 42 million people in the United States affected by addiction and greater visibility to the 100K people who died from drug overdoses. What Rent did for bringing attention to the AIDS epidemic and what Hamilton did for teaching people about American History, MPD was doing for the ravages of addiction on individuals, families, and organizations “one day at a time”.

As 2025 comes to a close wrapping up a remarkable and transformative, we look to 2026 with excitement to continue the positive momentum from this year.

Make your dash count!

MM