GSV’s weekly insights on the global growth economy. Join our community of entrepreneurs, investors, executives, educators, and students getting a window to the future by subscribing here:

EIEIO…Fast Facts

Entrepreneurship: 6 out of the past 10 - the fraction of U.S. Presidents who had no significant business experience before taking office. (Dash Media)

Innovation: 97.5% – the percentage reduction in cost per 1,000 tokens for GPT-4o vs. GPT-3.5 (from $0.0200 to $0.0005) in just 1.5 years. (Sarah Tavel)

Education: 30 cents – the amount of wealth held by families headed by someone with some college education (but no four-year degree) for every $1 of wealth held by families headed by a four-year college graduate. (St. Louis Fed)

Impact: $2.58 billion – the proposed amount of Name, Image, and Likeness (NIL) backpay that would be paid to 400,000 eligible athletes who competed in NCAA Division I sports from 2016 to 2024, as part of the House vs. NCAA lawsuit. (Sports Illustrated)

Opportunity: 23% – the percentage of U.S. adults who have chosen not to call an ambulance during a medical emergency due to the potential cost (YouGov)

“If he’s a good hitter, why doesn’t he hit good?” – Brad Pitt as Billy Beane in Moneyball

”He’s got an ugly girlfriend. Ugly girlfriend means no confidence.” – Oakland A’s Scout in Moneyball

“We are card counters at the blackjack table. And we are going to turn the odds on the casino.” – Brad Pitt as Billy Beane in Moneyball

Moneyball was a film based on Michael Lewis’ book about the 2002 Oakland A’s season where general manager Billy Beane used a data-driven approach to build a competitive team on a limited budget. Beane, much to the dismay of the tobacco-chewing veteran scouts and manager, hired a data analyst (Peter Brand) to evaluate players’ on-base percentage as the driving force in deciding who to have on the roster.

Traditionally, teams had overweighted subjective factors such as what a player looked like, and underweighted objective factors. “Looks good in a uniform” was a smart comment by the experts but a comment like “A walk is as good as a hit” would be treated like passing gas by that same group.

Great businesses and great investors are systematic and strategic in how they operate.

They are systematic in that they create processes for how they operate and make decisions. This yields consistency and predictability.

Great businesses are also strategic in that they do things that create advantages against their competition and drive outsized performance.

When I was a young research analyst covering everything that moved between Minneapolis and Seattle, one of the legendary small-cap investors I dealt with was a guy named Lee Kopp.

Lee had a nose for small companies with big potential and a track record that proved it. When I asked Lee how he picked stocks, he’d say “I buy them down here (pointing to his shoes) and I’d sell them up here” (pointing above his shoulders).

While clearly that must have been basically true, it wasn’t exactly a repeatable formula. Not surprisingly, when Lee retired in 2019, the firm closed.

When Jim Simons a.k.a. The “Quant King” passed in May, his firm Renaissance Technologies continued uninterrupted with its $100 billion-plus under management.

Casinos in the United States generated over $300 billion in revenue last year and paid nearly $60 billion in taxes. It’s a great business because the odds are always in the House’s favor. Blackjack dealers don’t make decisions on their own, they follow the script exactly. In the world of probabilities, the difference between a .275 batter and a .300 batter is one hit every two weeks.

Artificial Intelligence will allow us to “Moneyball” everything…from our health to our wealth to our wisdom.

From October 2023: EIEIO…Healthy, Wealthy, and Wise

“Healthy, Wealthy, and Wise: We do not view these pillars in individual siloes, but as interconnected components that drive the overarching objective to ignite Human Flourishing.”

The Megatrend for the past 20 years was “Software is Eating the World”.

Today, AI is its “teeth”.

BUT importantly, humans will decide what to eat.

It’s not Man vs. Machine…It’s Man and Machine.

In healthcare, AI is shown to be 90% or better in accurately diagnosing diseases based on medical imaging…a far better batting average than human doctors achieve on their own. Moreover, presenting alternative prescriptions not just with general pros and cons but with attached probabilities provides both doctors and patients with objective information to inform their decisions.

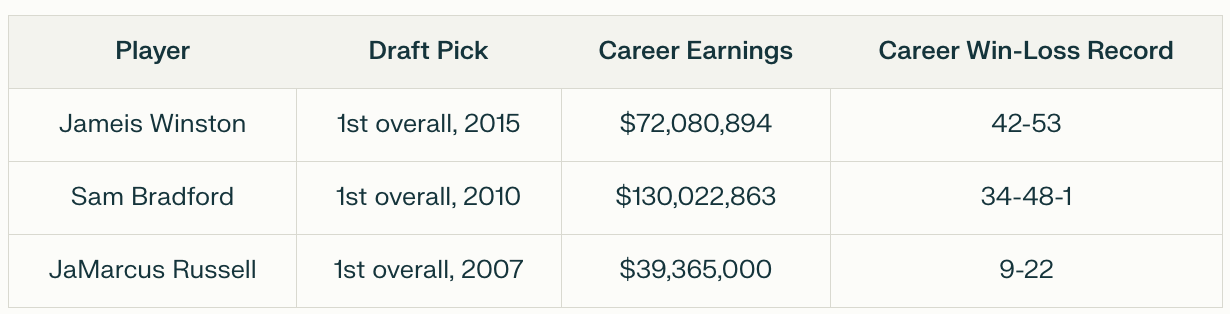

It’s fun to play Monday-morning quarterback and criticize the high-profile draft busts in professional sports. While it might be too early for a verdict on last year’s #1 pick Bryce Young with the Panthers, clear top-pick disasters in the past ~15 years include Jameis Winston, Sam Bradford, and JaMarcus Russell.

Given the volume of scrutiny, the amount of money on the line, and the size of the talent pool, how could such disastrous decisions have been made? Unbelievable, right?

Judge not and don’t be judged. Career builder says that 74% of employers admit to hiring the wrong person for a position. Additionally, nearly 2/3 of new hires globally are not working out as expected.

From December 2023: EIEIO…Talent Wars

“The success of an enterprise is directly correlated to its ability to obtain, train, and retain the best talent.”

Reasons cited for the bad hires:

Poor culture fit

Bad interpersonal skills

Unclear expectations with faulty communication

Poor hiring process

The cost of a bad hire can be anywhere from 1/3 of the individual’s first-year salary to as much as $240,000. A bad hire impacts morale, productivity, and mojo.

As we look at the road ahead, the effectiveness of nearly every organization on the planet will hinge on two critical elements: how we harness AI to provide analytics that inform our decisions and how we apply human judgment to those insights.

Or as Ronald Reagan said, “Trust, but verify.”

Market Performance

Market Commentary

Not exactly a mic drop moment, but Fed Chairman Powell’s “the time has come” comment about lowering rates was what the Market wanted to hear out of Jackson Hole. 2.5 years of the Chinese Water Torture of raising rates to get inflation in check is expected to end in September.

A soft July employment report combined with a nearly 1 million job negative revision also provided some incentive to bring some catalyst back into the economy.

For the week, stocks continued to march upwards with the S&P 500 advancing 1.5%, the NASDAQ moving up 1.4% and the Dow gaining 1.3%. The small-cap Russell 2000 continued to lead and was up 3.6% for the week. Interestingly, Gold, the safe haven in times of turmoil and inflation, made an all-time high last week reaching $2,500 a Troy ounce.

Notable individual stock moves included Cava which was up nearly 20% for the week on a 10% increase in foot traffic. Workday moved up approximately 10% on favorable forward guidance. Electric Vehicle makers Rivian and Tesla both had good weeks driven by conventional wisdom that lower interest rates are favorable for electric cars.

Legislation making non-competes unenforceable was rejected by the courts and California’s proposal to impose safety precautions and whistleblower protection for any company spending over $100 million on large language models is in for a fight. Google, agreed with California, to provide $250 million over five years to news organizations to support their efforts in the face of secular advertising headwinds.

We continue to see a constructive environment, fundamentals, and action from growth companies. While the S&P 500 and the Russell 2000 have approximately the same forward P/E multiple of 22.5X, we expect small caps to continue their strong performance. Accordingly, we remain BULLISH.

Need to Know

READ: The Big Stack Game of LLM Poker | Sarah Tavel

WATCH / LISTEN: 🎙️ Ep 20 · Joe Lonsdale: Founder & Managing Partner of 8VC | Ed on the Edge

READ: 🧐 Eric Schmidt’s AI prophecy: The next two years will shock you | Exponential View

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation.

#1: Inflows and Outflows for Mutual Funds & ETFs

#2: IPO Market

#3: Interest Rates

#4: Inflation

Charts of the Week

We’ve got maps today.

Maggie Moe’s GSV Weekly Rap

Chuckles of the Week

FEEDBACK: We love it when our readers engage with us. Send your thoughts, comments, and feedback to dashmediagsv@gmail.com – we read every email!

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup….EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM